Is the US Stock Market About to Crash?

author:US stockS -

Introduction

The stock market is a crucial component of the American economy, and it often mirrors the country's economic health. Lately, there has been a growing concern about whether the US stock market is about to crash. In this article, we will delve into the factors contributing to this fear, analyze the history of stock market crashes, and explore whether a crash is imminent.

Historical Perspective

Throughout history, the stock market has experienced several crashes. The most famous of these is the 1929 stock market crash, also known as the "Great Crash," which led to the Great Depression. More recently, the 2008 financial crisis resulted in the collapse of several major financial institutions and a severe global recession.

While it's difficult to predict the future, history has shown that various factors can lead to a stock market crash. Some of these factors include economic instability, political uncertainty, excessive leverage, and market bubbles.

Current Factors Contributing to Concerns

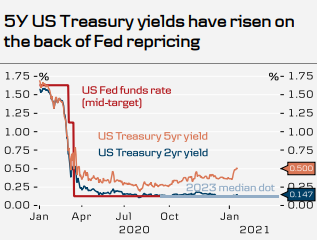

Inflation and Interest Rates: The Federal Reserve has been raising interest rates to combat high inflation. While this is a necessary measure, it can lead to increased borrowing costs for companies, potentially impacting their profitability.

Corporate Debt: Many companies have accumulated substantial debt in recent years, which could become unsustainable if economic conditions worsen.

Tech Sector: The technology sector has been a significant driver of the stock market's growth in recent years. However, concerns about the sector's valuation and potential over-reliance on it have raised questions about the market's stability.

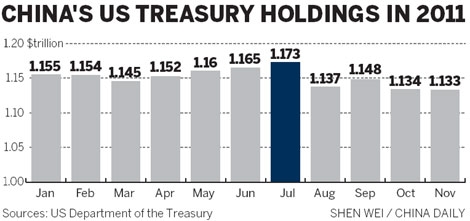

Global Economic Conditions: The US stock market is interconnected with the global economy. Concerns about China's economic slowdown and the Eurozone's potential crisis could impact the US market.

Analogy: The Tech Bubble of the Late 1990s

To better understand the potential for a stock market crash, let's examine the tech bubble of the late 1990s. The bubble was fueled by irrational exuberance and speculative investing in technology stocks. When the bubble burst in 2000, the NASDAQ lost about 80% of its value. This event serves as a reminder of how excessive optimism and speculation can lead to significant market corrections.

Market Bubbles and the Potential for a Crash

One of the key factors contributing to market bubbles is excessive optimism and speculative investing. Today, some analysts argue that the stock market is experiencing a similar bubble, particularly in the tech sector. While it's difficult to predict the future, the presence of a bubble increases the risk of a crash.

Conclusion

While concerns about a potential stock market crash are valid, it's essential to maintain a balanced perspective. History has shown that markets often experience corrections, but not all corrections lead to crashes. By understanding the factors contributing to market instability and staying informed, investors can better navigate the market's ups and downs. As always, it's crucial to consult with a financial advisor before making any investment decisions.

dow and nasdaq today