Is US Bank Stock a Good Buy?

author:US stockS -

Understanding the Current Market Trends

Are you considering investing in US Bank stock? If so, you're not alone. With the financial markets constantly evolving, investors are always on the lookout for promising opportunities. In this article, we delve into the factors that can help you determine whether US Bank stock is a good buy or not.

The US Bank Overview

US Bank, with its headquarters in Minneapolis, Minnesota, is one of the leading financial institutions in the United States. The bank offers a wide range of financial services, including retail banking, corporate banking, and wealth management. Its diverse portfolio has made it a favorite among investors.

Financial Performance

To assess whether US Bank stock is a good buy, it's crucial to analyze its financial performance. Over the years, US Bank has demonstrated strong profitability, with consistent growth in revenue and earnings.

Revenue Growth

One of the key indicators of a company's health is its revenue growth. In the past few years, US Bank has seen a steady increase in its revenue. This can be attributed to the bank's strong market position and the expanding financial services industry.

Earnings Per Share (EPS)

Another vital aspect to consider is the bank's earnings per share (EPS). US Bank has a history of delivering impressive EPS growth, reflecting its profitability and financial stability.

Dividend Yield

Investors often look for stocks with a good dividend yield. US Bank offers a competitive dividend yield, making it an attractive option for income-focused investors.

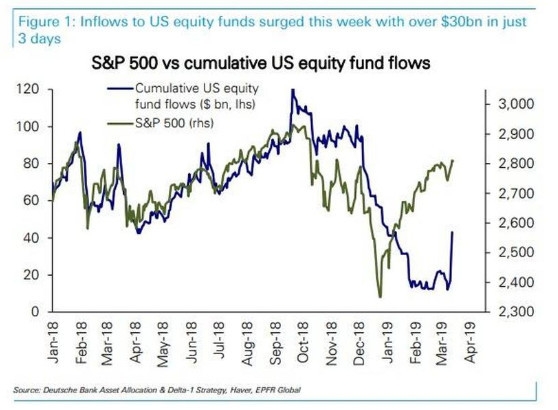

Market Conditions

The stock market is influenced by various factors, including economic indicators, interest rates, and geopolitical events. To make an informed decision, it's important to consider the current market conditions.

Economic Indicators

Positive economic indicators, such as low unemployment rates and rising consumer spending, can boost the stock market. In recent years, the US economy has shown strong growth, which may be beneficial for US Bank stock.

Interest Rates

Interest rates play a significant role in the banking sector. As interest rates rise, banks tend to benefit from higher net interest margins. However, it's important to monitor the Federal Reserve's policy decisions, as they can impact the banking industry.

Geopolitical Events

Geopolitical events, such as trade wars or political instability, can cause volatility in the stock market. Investors should stay informed about these events and their potential impact on US Bank stock.

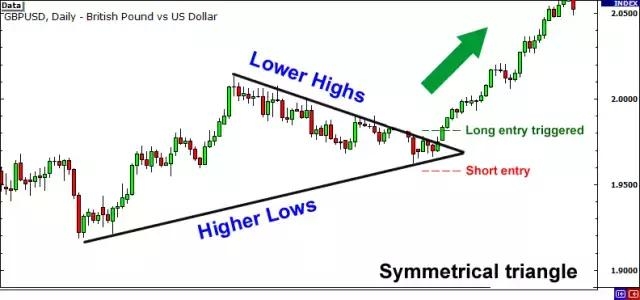

Comparative Analysis

To determine whether US Bank stock is a good buy, it's helpful to compare it with its peers in the banking sector. By analyzing key metrics such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and return on equity (ROE), you can gauge US Bank's competitiveness.

P/E Ratio

A lower P/E ratio indicates that a stock is undervalued. US Bank's P/E ratio has been relatively stable, suggesting that the stock may not be overvalued.

P/B Ratio

The P/B ratio measures a company's market value relative to its book value. US Bank's P/B ratio has been favorable, indicating that the stock may be undervalued.

ROE

US Bank's ROE has been impressive, reflecting the bank's profitability and efficient use of its equity.

Conclusion

Considering the bank's financial performance, dividend yield, and favorable market conditions, US Bank stock appears to be a good buy. However, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

dow and nasdaq today