Impact of U.S. Midterm Elections on Stock Market

author:US stockS -

The U.S. midterm elections hold significant sway over various sectors, and the stock market is no exception. With the polls closing, investors are eager to understand the potential impact of these elections on the financial landscape. This article delves into how the outcomes of the midterm elections can shape the stock market, offering insights into key sectors and market indicators.

Understanding the Midterm Elections

The midterm elections, held every two years, see the election of members of Congress to the House of Representatives and one-third of the Senate. These elections are pivotal as they often serve as a barometer of public opinion and can significantly influence policy-making.

Potential Impacts on the Stock Market

Political Uncertainty

Political uncertainty is a major concern for investors. The outcome of the midterm elections can lead to increased volatility in the stock market. A divided government, where control of Congress is split between the two major parties, can result in gridlock and a lack of decisive action on key issues. This uncertainty can lead to a sell-off in the stock market.

Tax and Regulatory Policies

The midterm elections can have a direct impact on tax and regulatory policies, which in turn affect corporate earnings and the stock market. For instance, if Democrats win control of the House, they may push for more progressive tax policies and increased regulation on certain industries, such as healthcare and technology. Conversely, a Republican-controlled House may favor tax cuts and deregulation, benefiting sectors like energy and finance.

Interest Rates

The midterm elections can also influence the Federal Reserve's stance on interest rates. A divided government may lead to a slower pace of rate hikes, which can be positive for the stock market. However, if one party gains control of both houses, the Fed's policies may be more predictable, potentially leading to higher interest rates and a more cautious approach to investing.

Key Sectors to Watch

Energy

With potential changes in regulatory policies, the energy sector is a key area to watch. A shift towards more progressive policies could negatively impact the sector, while a Republican-controlled House could favor continued growth.

Technology

The technology sector has faced increasing scrutiny in recent years. A Democratic-controlled House could lead to stricter regulations and potentially impact the sector's growth. Conversely, a Republican-controlled House may favor a lighter regulatory hand.

Healthcare

The healthcare sector is another area where the midterm elections could have a significant impact. A shift towards more progressive policies could lead to changes in healthcare legislation and insurance regulations, potentially affecting the sector's performance.

Case Studies

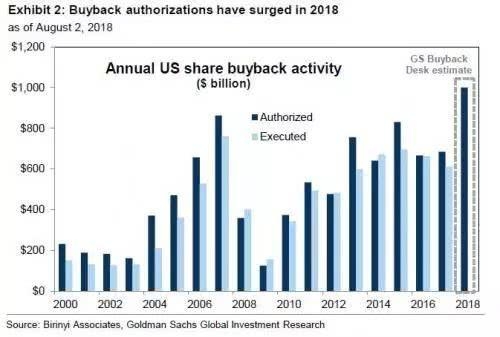

One notable example is the 2018 midterm elections, where Democrats took control of the House. This led to increased volatility in the stock market, as investors grappled with the potential for more regulation and gridlock in Washington. Despite this uncertainty, the stock market eventually recovered and continued to rise.

Conclusion

The midterm elections have the potential to significantly impact the stock market. With the polls closed, investors are now waiting to see how the outcomes will shape the financial landscape. Whether through changes in policy, regulatory environments, or political uncertainty, the midterm elections are a critical event for those invested in the stock market.

dow and nasdaq today