How to Trade HK Stock in the US: A Comprehensive Guide

author:US stockS -

Are you looking to diversify your investment portfolio and include Hong Kong stocks? Trading Hong Kong stocks from the United States can be a lucrative opportunity, but it requires understanding the process and regulations. In this comprehensive guide, we'll walk you through the steps to trade HK stock in the US, helping you make informed decisions and maximize your investment potential.

Understanding the Basics

Hong Kong is known for its thriving stock market, offering a wide range of companies across various sectors. As an investor in the US, you have the opportunity to access these markets and invest in companies listed on the Hong Kong Stock Exchange (HKEX). However, it's important to note that trading HK stock in the US has some unique considerations.

Choosing a Broker

The first step in trading HK stock in the US is to choose a broker that offers access to the Hong Kong stock market. Not all brokers provide this service, so it's crucial to select one that specializes in international trading. Some popular brokers for trading HK stock include Fidelity, Charles Schwab, and TD Ameritrade.

Opening an Account

Once you've chosen a broker, the next step is to open an account. This process is similar to opening an account for US stocks. You'll need to provide personal information, including your name, address, and Social Security number. Additionally, you may need to provide proof of identity and residency, as well as complete a questionnaire regarding your investment experience and risk tolerance.

Understanding the HK Stock Market

Before diving into trading, it's important to familiarize yourself with the Hong Kong stock market. The HKEX is the largest stock exchange in Hong Kong, and it lists companies from various sectors, including finance, technology, and real estate. Some of the most notable companies listed on the HKEX include Tencent, Alibaba, and HSBC.

Researching HK Stocks

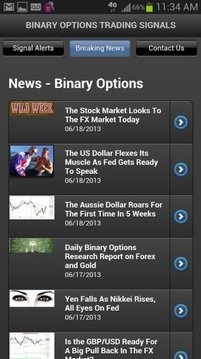

To make informed investment decisions, it's crucial to conduct thorough research on the stocks you're interested in. This includes analyzing financial statements, studying market trends, and staying updated on news and events that may impact the stock price. Some resources for researching HK stocks include Bloomberg, Yahoo Finance, and the HKEX website.

Executing Trades

Once you've done your research and identified stocks you want to invest in, you can execute trades through your broker's platform. Most brokers offer online trading platforms that allow you to buy and sell stocks with just a few clicks. Be sure to understand the fees and commissions associated with trading HK stock in the US, as these can vary by broker.

Monitoring Your Investments

After executing trades, it's important to monitor your investments regularly. This includes reviewing your portfolio, staying informed about market trends, and adjusting your investments as needed. Some investors prefer to use stop-loss orders to protect against significant losses.

Case Study: Tencent

Let's take a look at a real-world example. Tencent, a leading Chinese technology company, is listed on the HKEX. An investor in the US who understands the Hong Kong stock market and conducts thorough research on Tencent may find it to be a valuable addition to their portfolio. By monitoring the stock and adjusting their position as needed, the investor can potentially benefit from the company's growth and success.

In conclusion, trading HK stock in the US can be a rewarding investment opportunity. By choosing the right broker, opening an account, conducting thorough research, and executing trades, you can diversify your portfolio and potentially maximize your investment returns. Remember to stay informed, monitor your investments, and make informed decisions to succeed in the HK stock market.

dow and nasdaq today