How to Invest in US Stocks from Iraq: A Comprehensive Guide

author:US stockS -

Are you an investor in Iraq looking to diversify your portfolio with US stocks? Investing in American companies can be a smart move, but it's important to understand the process and potential risks. In this guide, we'll walk you through the steps to invest in US stocks from Iraq, ensuring you make informed decisions.

Understanding the Market

Before diving into the investment process, it's crucial to understand the US stock market. The United States is home to some of the world's largest and most successful companies, offering a wide range of investment opportunities. The most popular exchanges for trading US stocks are the New York Stock Exchange (NYSE) and the NASDAQ.

Opening a Brokerage Account

To invest in US stocks from Iraq, you'll need to open a brokerage account with a reputable firm. Many international brokers offer services to Iraqi investors, making it easier to trade US stocks. When choosing a broker, consider factors such as fees, customer service, and available investment options.

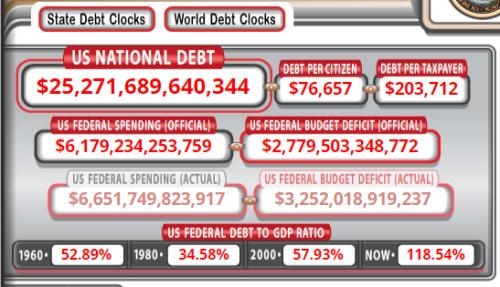

Understanding the Risks

Investing in US stocks carries its own set of risks, including market volatility and currency fluctuations. It's important to research and understand these risks before making any investment decisions. Additionally, be aware of the potential for political and economic instability in Iraq, which can impact your investments.

Researching and Selecting Stocks

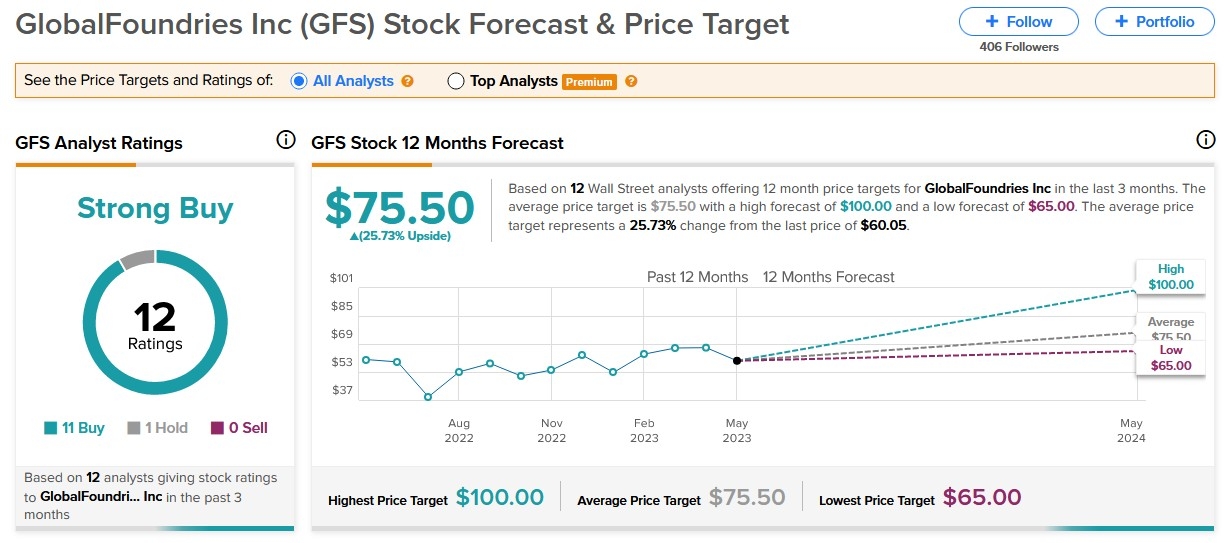

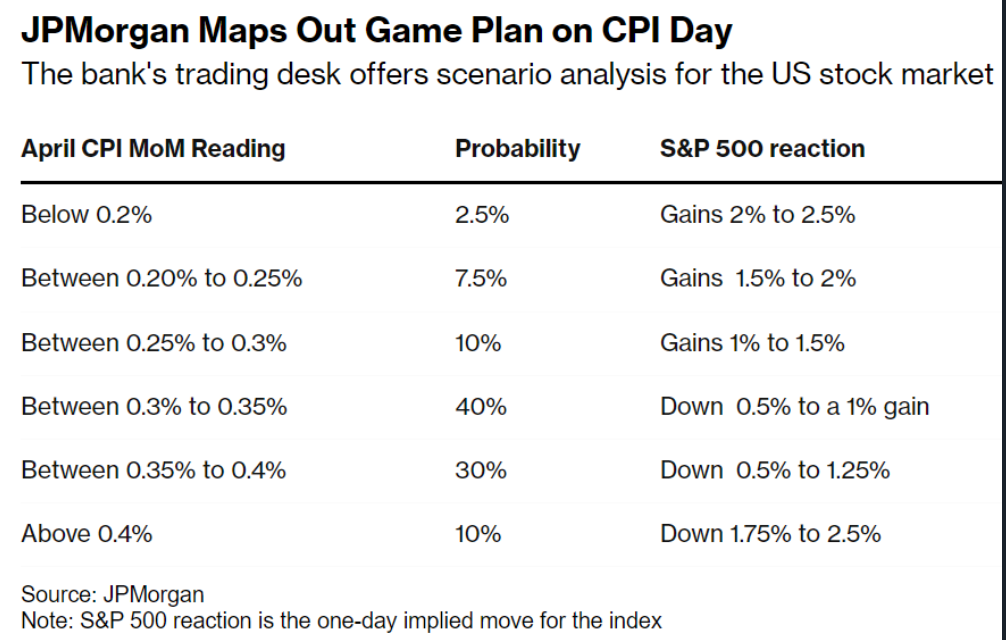

Once you have your brokerage account, it's time to start researching and selecting stocks. Consider factors such as the company's financial health, industry trends, and market position. Utilize online resources, financial news, and expert analysis to inform your investment decisions.

Using Online Trading Platforms

Many brokers offer online trading platforms that make it easy to buy and sell US stocks. These platforms typically provide real-time market data, research tools, and advanced trading features. Familiarize yourself with the platform's interface and features to ensure a smooth trading experience.

Currency Conversion and Fees

When investing in US stocks from Iraq, you'll need to consider currency conversion and fees. Most brokers charge a fee for currency conversion, which can impact your investment returns. Additionally, be aware of any fees associated with your brokerage account, such as account maintenance fees or transaction fees.

Monitoring Your Investments

Once you've invested in US stocks, it's important to monitor your portfolio regularly. Keep an eye on market trends, company news, and economic indicators that could impact your investments. Consider setting up alerts to notify you of significant changes in your portfolio.

Diversifying Your Portfolio

Diversifying your portfolio can help mitigate risk and potentially increase your returns. Consider investing in a mix of stocks, bonds, and other assets to create a well-rounded investment strategy. This can help protect your investments against market downturns and economic instability.

Case Study: Investing in Apple (AAPL)

Let's say you're interested in investing in Apple Inc. (AAPL), one of the world's most valuable companies. After researching the company's financials and industry position, you decide to purchase 100 shares of Apple stock at

In conclusion, investing in US stocks from Iraq is possible with the right approach. By understanding the market, opening a brokerage account, researching stocks, and monitoring your investments, you can build a diversified portfolio and potentially achieve significant returns. Remember to consider the risks and consult with a financial advisor if necessary.

dow and nasdaq today