How the 2008 Stock Market Crash Affected Us

author:US stockS -

The 2008 stock market crash was one of the most devastating financial events in modern history. It shook the global economy and had profound effects on individuals, businesses, and governments worldwide. This article delves into the impact of the 2008 stock market crash on various aspects of life, highlighting its long-lasting repercussions.

Economic Consequences

The 2008 crash led to a severe economic downturn, often referred to as the Great Recession. This period was marked by skyrocketing unemployment rates, falling property values, and a general sense of economic uncertainty. The crash's aftermath caused many businesses to shut down, leading to a significant increase in unemployment. For instance, the unemployment rate in the United States reached a peak of 10% in October 2009.

Impact on Personal Finances

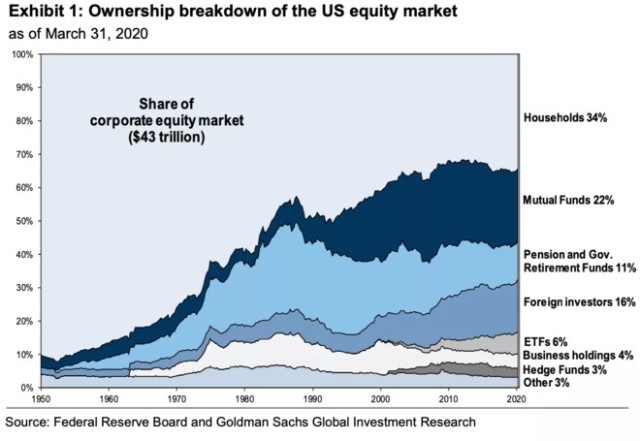

Individuals felt the brunt of the 2008 crash through their personal finances. Many people saw their retirement savings dwindle as the stock market plummeted. The crash prompted a shift in investor sentiment, with a growing number of individuals becoming wary of the stock market. For example, the S&P 500 lost approximately 57% of its value between October 2007 and March 2009.

Real Estate Market

The real estate market was also severely impacted by the 2008 crash. Home prices plummeted, and many homeowners found themselves in negative equity situations, where their homes were worth less than the amount they owed on their mortgages. This led to a rise in foreclosures and a decline in home sales.

Government Interventions

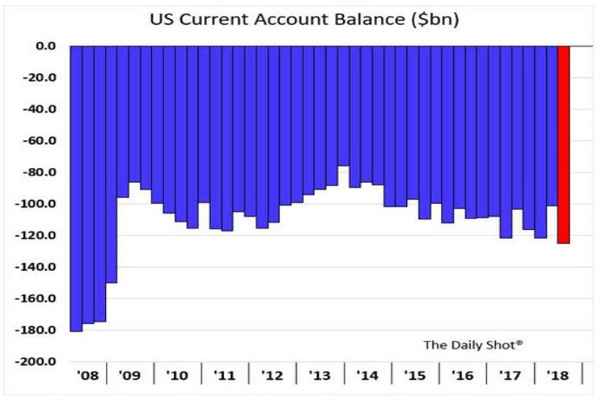

To mitigate the effects of the crash, governments around the world implemented various intervention measures. The U.S. government, for instance, passed the Emergency Economic Stabilization Act of 2008, which provided $700 billion to bail out financial institutions. Additionally, the Federal Reserve lowered interest rates to near-zero levels to stimulate economic growth.

Long-term Effects

The 2008 stock market crash had long-term effects on the global economy. It led to a shift in regulatory policies, with governments around the world tightening financial regulations to prevent future crises. The crash also accelerated the adoption of new technologies and business models, as companies sought to adapt to the changing economic landscape.

Case Studies

One notable case study of the 2008 crash is the collapse of Lehman Brothers. The bankruptcy of this investment bank triggered a domino effect, leading to the failure of several other financial institutions. This event highlighted the interconnectedness of the global financial system and the potential for a single event to have widespread consequences.

Another case study is the impact of the crash on the automobile industry. Many car manufacturers, such as General Motors and Chrysler, faced financial difficulties during the crisis. The U.S. government stepped in to provide financial assistance, which helped these companies survive and eventually recover.

Conclusion

The 2008 stock market crash had far-reaching consequences, affecting economies, individuals, and governments worldwide. It served as a wake-up call for the need for better financial regulation and a more resilient economy. While the crash's immediate effects were devastating, its long-term impact has prompted positive changes in the global financial system.

dow and nasdaq today