How Many U.S. Citizens Own Stocks?

author:US stockS -

In the ever-evolving financial landscape of the United States, the question of how many citizens own stocks has become a topic of significant interest. This article delves into the statistics, trends, and reasons behind the growing popularity of stock ownership among Americans. From individual investors to institutional players, the stock market has become an integral part of the financial lives of many.

Stock Ownership in the U.S.

According to recent studies, a substantial number of U.S. citizens own stocks. In fact, it is estimated that over 50% of American adults have some form of stock investment. This includes individual investors, retirement accounts, and mutual funds.

Reasons for Stock Ownership

There are several reasons why so many Americans own stocks:

Potential for High Returns: Stocks have historically offered higher returns compared to other investment vehicles such as bonds or savings accounts. This allure of potentially high returns attracts many investors to the stock market.

Diversification: Owning stocks in various companies across different industries helps investors diversify their portfolios, reducing the risk of loss in case of market downturns.

Ease of Access: With the advent of online brokerage platforms and mobile apps, it has become easier than ever for individuals to buy and sell stocks. This accessibility has played a significant role in the rise of stock ownership among the general population.

Retirement Planning: Many Americans invest in stocks through retirement accounts such as 401(k)s and IRAs. These accounts offer tax advantages and are designed to provide financial security in retirement.

Social Security: Some individuals view stock ownership as a means to supplement their Social Security benefits in retirement.

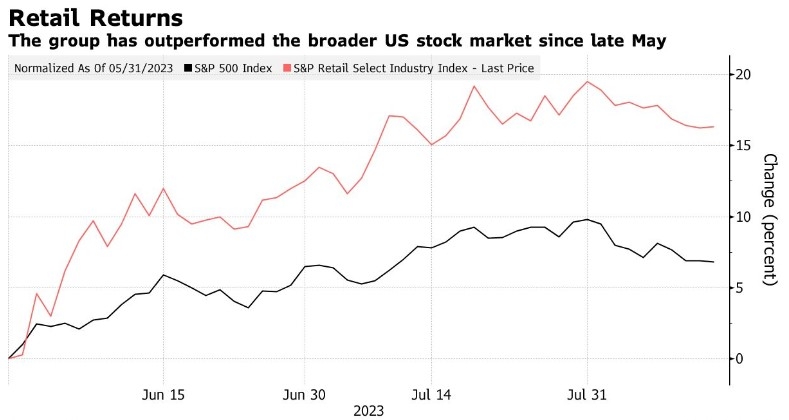

The Growing Trend of Retail Investors

The rise of retail investors has been a significant trend in recent years. Platforms like Robinhood and TD Ameritrade have made it easier for individuals to buy and sell stocks. This has led to a surge in the number of Americans owning stocks, especially among younger generations.

Case Study: The Millennial Generation

The millennial generation, born between 1981 and 1996, has been a driving force behind the increase in stock ownership. Many millennials have embraced the stock market as a way to achieve financial independence and secure their futures. According to a survey by Charles Schwab, 60% of millennials own stocks, and they are expected to control over $30 trillion in wealth by 2030.

Conclusion

In conclusion, the number of U.S. citizens owning stocks has reached an all-time high. This trend is driven by factors such as the potential for high returns, ease of access, and the growing popularity of retail investors. As the stock market continues to evolve, it is likely that more Americans will embrace stock ownership as a key component of their financial strategy.

dow and nasdaq today