How Many Microcap Stocks in the US?

author:US stockS -

In the vast landscape of the US stock market, microcap stocks have gained significant attention due to their potential for high returns. These stocks, often overshadowed by their larger counterparts, are characterized by their low market capitalization. But just how many microcap stocks are there in the US? Let's delve into this topic and explore the world of microcap stocks.

Understanding Microcap Stocks

Microcap stocks are typically defined as companies with a market capitalization of less than $300 million. These stocks are often associated with small, emerging businesses that may not have the financial resources or track record to attract larger institutional investors. However, this does not diminish their potential for growth and profitability.

The Number of Microcap Stocks

As of the latest available data, there are approximately 10,000 microcap stocks listed on exchanges in the US. This figure includes stocks listed on major exchanges such as the NYSE, NASDAQ, and regional exchanges. It's important to note that this number can fluctuate over time due to market conditions, regulatory changes, and company performance.

Why Invest in Microcap Stocks?

Investing in microcap stocks can be an attractive opportunity for several reasons:

- High Growth Potential: Microcap stocks often represent companies in the early stages of growth, which can lead to significant returns if the business succeeds.

- Low Market Competition: These stocks are typically less known and followed by the broader market, which can provide an opportunity to get in early and potentially benefit from higher returns.

- Diversification: Investing in a diversified portfolio of microcap stocks can help reduce risk, as the performance of these stocks is often not correlated with the broader market.

Risks of Investing in Microcap Stocks

While there are potential benefits to investing in microcap stocks, it's important to be aware of the risks involved:

- High Volatility: Microcap stocks can be highly volatile, with prices fluctuating significantly in a short period of time.

- Lack of Research: Due to their small size, these companies may not receive as much research coverage as larger companies, making it more challenging for investors to gather information.

- Higher Risk of Failure: Microcap stocks are more likely to fail compared to larger, more established companies, which can result in significant losses for investors.

Case Studies

To illustrate the potential of microcap stocks, let's look at a couple of case studies:

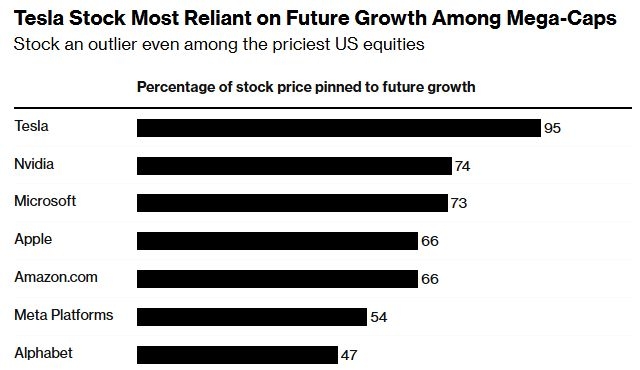

- Tesla: Once a microcap stock, Tesla has grown into a $1 trillion company. Investors who bought Tesla's microcap stock early on have seen their investments multiply exponentially.

- Facebook: Originally known as TheFacebook, this social media giant started as a microcap stock before going public and becoming one of the most valuable companies in the world.

In conclusion, there are approximately 10,000 microcap stocks listed on exchanges in the US. While these stocks come with risks, they also offer potential for high returns. As with any investment, it's crucial to conduct thorough research and understand the risks involved before investing in microcap stocks.

dow and nasdaq today