Has the Market Crashed? A Comprehensive Analysis

author:US stockS -

In recent times, the stock market has been a hot topic of discussion among investors and financial experts. With numerous fluctuations and unpredictability, many are left wondering: Has the market crashed? This article delves into the current state of the market, analyzes recent trends, and explores the factors that might have contributed to the uncertainty.

Understanding Market Crashes

Before we can answer the question of whether the market has crashed, it's crucial to understand what constitutes a market crash. Generally, a market crash is characterized by a rapid and significant decline in the value of financial assets, such as stocks, bonds, and commodities. This decline often occurs over a short period and is usually accompanied by a high level of panic and uncertainty among investors.

Recent Market Trends

In the past few months, the stock market has experienced significant volatility. While the market has not officially crashed, it has certainly seen its share of ups and downs. Here are some key trends to consider:

- Rising Inflation: Inflation has been a major concern for investors in recent months. The U.S. Consumer Price Index (CPI) has been rising at a rapid pace, leading to concerns about the potential for higher interest rates and a potential recession.

- Geopolitical Tensions: Tensions between the United States and China, as well as other geopolitical issues, have contributed to market uncertainty. These tensions have raised concerns about global economic stability and the potential for trade wars.

- Technological Advancements: The rapid pace of technological advancements has also contributed to market volatility. As new technologies emerge, they can disrupt traditional industries and create uncertainty among investors.

Factors Contributing to Market Uncertainty

Several factors have contributed to the current state of market uncertainty:

- Economic Data: The release of economic data, such as GDP growth, employment figures, and inflation rates, can significantly impact investor sentiment and market performance.

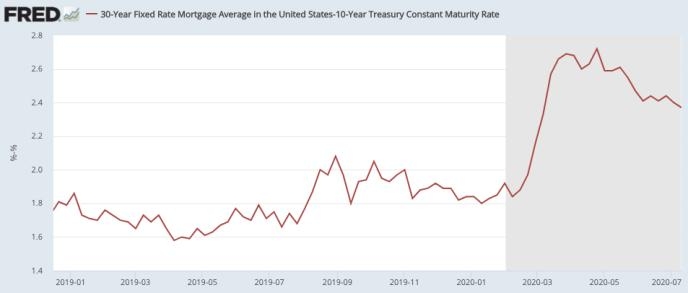

- Central Bank Policies: The actions of central banks, such as the Federal Reserve, can have a profound impact on the market. For example, the possibility of interest rate hikes can lead to higher borrowing costs and potentially slower economic growth.

- Corporate Earnings: The performance of individual companies can also influence market sentiment. Companies that report strong earnings can boost investor confidence, while those with weak results can lead to increased volatility.

Case Studies

To illustrate the impact of market uncertainty, let's consider two recent examples:

- Tesla's Stock Price Volatility: In the past year, Tesla's stock price has experienced significant volatility. This volatility can be attributed to various factors, including concerns about the company's ability to meet production targets and the impact of new regulations on the automotive industry.

- Apple's Stock Price Decline: In early 2022, Apple's stock price experienced a significant decline. This decline was partly due to concerns about the company's future growth prospects, as well as the global supply chain disruptions caused by the COVID-19 pandemic.

Conclusion

While the stock market has experienced significant volatility in recent months, it has not officially crashed. However, the factors contributing to market uncertainty remain, and investors should remain vigilant and stay informed about the latest trends and developments. By understanding the market's current state and the factors that influence it, investors can make more informed decisions and navigate the volatile landscape with greater confidence.

dow and nasdaq today