Has International Stock Market Underperformed US?

author:US stockS -

Understanding the Global Stock Market Landscape

In recent years, the global stock market has been a subject of intense scrutiny. One significant trend has emerged: the international stock market has underperformed the US. This article delves into the reasons behind this discrepancy and analyzes the implications for investors.

What Drives Stock Market Performance?

Stock market performance is influenced by various factors, including economic indicators, political stability, and market sentiment. The US stock market, particularly the S&P 500, has been lauded for its resilience and growth over the past decade. This has raised questions about the underperformance of international markets.

Economic Indicators: A Key Factor

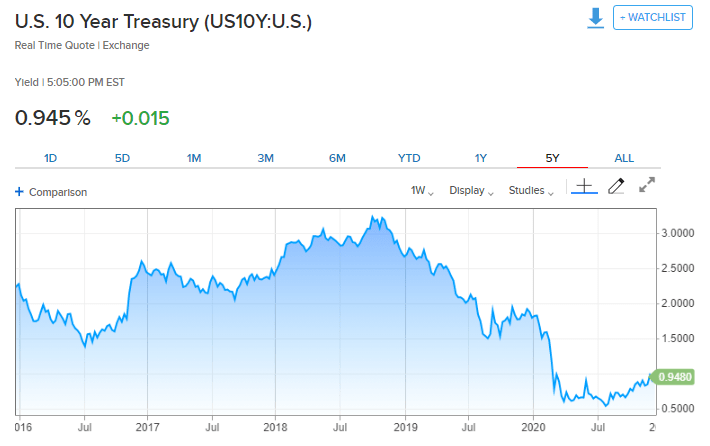

One primary reason for the underperformance of international markets is economic indicators. The US economy has shown robust growth, with low unemployment rates and a stable currency. This has attracted investors seeking high returns.

In contrast, some international markets have faced challenges. For instance, the European Union has grappled with issues such as Brexit and the Greek debt crisis. These events have caused uncertainty and volatility in the region's stock markets.

Political Stability: A Critical Factor

Political stability is another critical factor that influences stock market performance. The US has been perceived as a stable and predictable investment destination. This stability has drawn investors looking for long-term investments.

In contrast, some international markets have faced political turmoil. For example, political instability in the Middle East has affected the performance of markets in the region.

Market Sentiment: An Important Influence

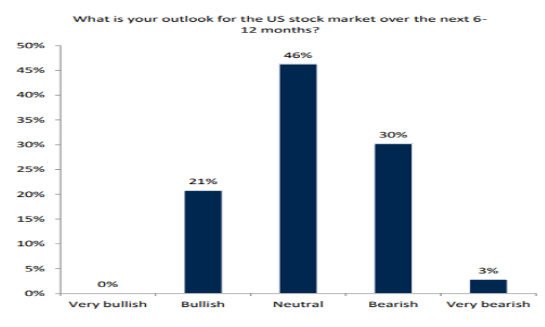

Market sentiment also plays a crucial role in stock market performance. Investors often react to global events and news, which can cause market fluctuations.

The US stock market has benefited from a positive market sentiment, driven by factors such as strong economic indicators and political stability. This has led to increased investor confidence and higher stock prices.

Case Studies: Comparing International and US Stock Markets

To illustrate the differences between international and US stock markets, let's consider two case studies.

Case Study 1: European Stock Market

The European stock market has underperformed the US in recent years. One primary reason for this is the economic uncertainty caused by Brexit. The uncertainty surrounding the UK's departure from the European Union has affected investor confidence and market performance.

Case Study 2: US Stock Market

In contrast, the US stock market has been lauded for its resilience and growth. Factors such as strong economic indicators and political stability have contributed to its performance.

Investment Implications

The underperformance of international markets relative to the US has important implications for investors. Those looking for high returns may consider diversifying their portfolios to include international stocks.

However, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

Conclusion

The underperformance of international stock markets compared to the US can be attributed to various factors, including economic indicators, political stability, and market sentiment. While the US stock market has shown remarkable resilience and growth, investors should be aware of the risks associated with international markets and consider diversifying their portfolios accordingly.

dow and nasdaq today