Hang Seng Bank and US Stocks: A Strategic Investment Opportunity

author:US stockS -

In the ever-evolving world of finance, investors are constantly seeking new opportunities to diversify their portfolios. One such opportunity lies in the partnership between Hang Seng Bank and US stocks. This article delves into the strategic benefits of investing in US stocks through Hang Seng Bank, highlighting the unique advantages and potential returns.

Understanding Hang Seng Bank

Hang Seng Bank, a leading financial institution in Hong Kong, has a long-standing reputation for excellence in banking services. With a strong presence in Asia and a growing global footprint, Hang Seng Bank offers a wide range of financial products and services, including investment banking, wealth management, and retail banking.

The US Stock Market: A Booming Opportunity

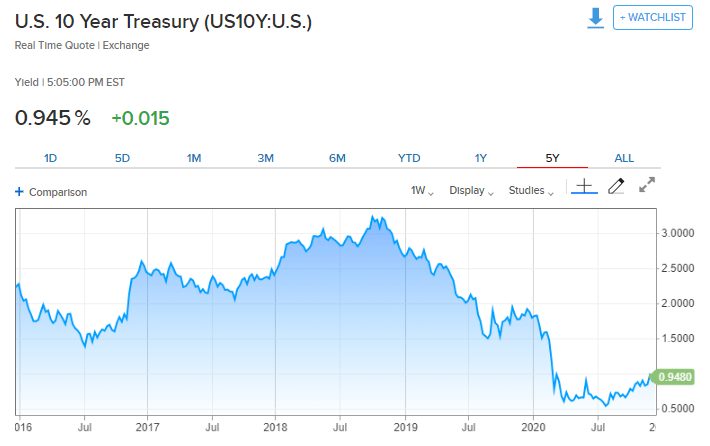

The US stock market is one of the most dynamic and lucrative markets in the world. It offers investors access to a diverse range of companies across various industries, from technology and healthcare to energy and finance. The US stock market has also been a significant driver of economic growth and innovation, making it an attractive destination for investors seeking long-term returns.

Investing in US Stocks through Hang Seng Bank

Hang Seng Bank provides investors with a convenient and secure platform to invest in US stocks. The bank offers a range of investment options, including direct stock purchases, ETFs (Exchange-Traded Funds), and mutual funds. By leveraging Hang Seng Bank's expertise and resources, investors can gain access to the US stock market with ease.

Benefits of Investing in US Stocks through Hang Seng Bank

Diversification: Investing in US stocks through Hang Seng Bank allows investors to diversify their portfolios, reducing risk and enhancing potential returns. The US stock market offers exposure to a wide range of industries and sectors, enabling investors to spread their investments across various markets.

Expertise: Hang Seng Bank's team of experienced financial advisors can provide personalized investment advice and guidance, helping investors make informed decisions. The bank's comprehensive research and analysis tools also enable investors to stay updated on market trends and investment opportunities.

Convenience: Hang Seng Bank offers a user-friendly online platform, making it easy for investors to monitor their investments and execute trades. The bank also provides access to a range of investment tools and resources, ensuring a seamless investment experience.

Security: Hang Seng Bank is committed to providing a secure and reliable investment platform. The bank employs advanced security measures to protect investors' assets and ensure the integrity of their investments.

Case Study: Investing in US Stocks through Hang Seng Bank

Consider an investor who decides to invest in US stocks through Hang Seng Bank. The investor selects a diversified portfolio of ETFs, which provides exposure to a range of sectors and industries. Over the course of one year, the investor's investments generate a significant return, thanks to the strong performance of the US stock market.

Conclusion

Investing in US stocks through Hang Seng Bank presents a strategic opportunity for investors seeking to diversify their portfolios and capitalize on the potential of the US stock market. With Hang Seng Bank's expertise, resources, and commitment to security, investors can confidently explore this exciting investment opportunity.

dow and nasdaq today