Graph of Us Stock Market Leverage: Understanding the Dynamics

author:US stockS -

In the fast-paced world of finance, understanding the leverage in the US stock market is crucial for investors and market analysts alike. This article delves into the graph of US stock market leverage, explaining its significance and the factors that influence it. By the end, you'll have a clearer picture of how leverage impacts the stock market and what it means for your investments.

What is Stock Market Leverage?

Stock market leverage refers to the use of borrowed capital to increase the potential return on an investment. It's a tool that allows investors to amplify their gains, but it also increases the risk. Leverage is typically measured by the debt-to-equity ratio, which compares a company's debt to its equity.

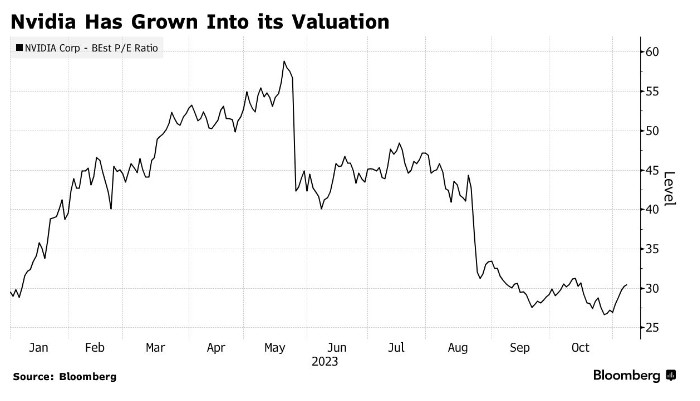

The Graph of US Stock Market Leverage

The graph of US stock market leverage shows the relationship between leverage and market performance over time. It's important to note that leverage can vary widely across different sectors and individual companies.

Influence of Leverage on Stock Market Performance

Leverage can have a significant impact on stock market performance. Here's how:

- Growth Potential: High leverage can lead to higher returns, as investors can invest more capital in potentially profitable ventures.

- Risk: Conversely, high leverage also increases the risk of losses, as a small decline in asset value can lead to a significant loss of capital.

- Market Volatility: Leverage can contribute to market volatility, as it amplifies the effects of market movements.

Factors Influencing Stock Market Leverage

Several factors influence the level of leverage in the US stock market:

- Interest Rates: Lower interest rates encourage borrowing, leading to higher leverage.

- Economic Conditions: During periods of economic growth, companies may be more willing to take on debt to expand their operations.

- Regulatory Environment: Regulatory changes can impact the level of leverage in the market.

Case Studies

To illustrate the impact of leverage, let's look at a few case studies:

- Tech Sector: The tech sector has historically been known for its high leverage. Companies like Facebook and Amazon have used debt to fund their rapid growth.

- Financial Sector: The financial sector is another area where leverage is common. Banks and investment firms use debt to increase their lending and investment activities.

Conclusion

Understanding the graph of US stock market leverage is essential for investors looking to navigate the complexities of the market. By analyzing the factors that influence leverage and its impact on market performance, investors can make more informed decisions and manage their risk effectively.

dow and nasdaq today