Goldman Sachs and Apple Drag US Stocks Lower: City AM

author:US stockS -

The US stock market experienced a downturn this week, primarily driven by major players such as Goldman Sachs and Apple. This article delves into the factors contributing to this decline and the potential implications for the market.

Goldman Sachs' Dismal Outlook

Goldman Sachs, one of the world's leading investment banks, recently issued a bleak outlook for the global economy. The bank's analysts predicted a slowdown in economic growth, particularly in the United States. This outlook has led to a decrease in investor confidence, resulting in a sell-off of stocks across various sectors.

Apple's Slowing Growth

Apple, the world's most valuable company, has also been a major contributor to the decline in the US stock market. The tech giant reported slower-than-expected revenue growth in its latest earnings report. This has raised concerns about the company's future prospects and the broader technology sector.

Impact on US Stocks

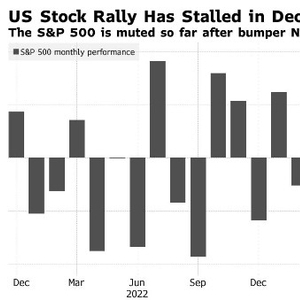

The negative sentiment from Goldman Sachs and Apple has had a significant impact on the US stock market. The S&P 500, a widely followed index of the largest companies in the United States, has fallen sharply in recent days. Many other indices, including the NASDAQ and the Dow Jones Industrial Average, have also experienced notable declines.

Sector-Specific Implications

The downturn in the US stock market has affected various sectors differently. The technology sector, which includes major companies like Apple, has been hit particularly hard. This is due to concerns about slowing growth and increased competition. The financial sector, led by Goldman Sachs, has also been affected, as investors react to the bank's pessimistic outlook.

Investor Sentiment

The recent downturn in the US stock market has raised concerns about investor sentiment. Many investors are now questioning the future of the market and whether it is time to sell off their investments. However, others argue that this is a temporary setback and that the market will recover in the long term.

Case Study: Tesla

A notable case study of the impact of major companies on the stock market is Tesla. The electric vehicle manufacturer has seen its stock price fluctuate significantly in recent months, driven by both positive and negative news. For example, when Tesla reported strong earnings, its stock price surged. Conversely, when the company faced regulatory challenges, its stock price plummeted.

Conclusion

The recent downturn in the US stock market, driven by major players such as Goldman Sachs and Apple, has raised concerns about the future of the market. While the situation is concerning, it is important for investors to maintain a long-term perspective and consider the broader economic landscape.

dow and nasdaq today