Funeral Stocks: A Growing Trend in the US

author:US stockS -

In recent years, the funeral industry has seen a significant transformation, with funeral stocks becoming increasingly popular among investors. This article delves into the reasons behind this growing trend and examines the potential of funeral stocks in the US market.

Understanding Funeral Stocks

Funeral stocks are shares of companies that provide funeral services, such as cremation, burial, and memorial services. These companies also offer products like caskets, urns, and other funeral-related items. As the demand for funeral services continues to rise, these stocks have become a hot topic among investors.

The Rising Demand for Funeral Services

The demand for funeral services has been steadily increasing due to several factors. Firstly, the aging population is a significant driver. According to the U.S. Census Bureau, the number of Americans aged 65 and older is projected to double by 2060. This demographic shift has led to a higher demand for funeral services.

Secondly, changing cultural attitudes towards death have also contributed to the growing demand. More people are opting for cremation over traditional burial, which has increased the need for cremation services and related products.

Investing in Funeral Stocks

Investing in funeral stocks can be a lucrative opportunity, especially for those who are looking for long-term investments. Here are some key reasons why funeral stocks are a good investment:

- Stable Demand: The demand for funeral services is relatively stable, as it is driven by demographics and cultural factors. This stability makes funeral stocks a reliable investment.

- Growth Potential: With the aging population and changing cultural attitudes, the demand for funeral services is expected to continue growing. This growth potential makes funeral stocks an attractive investment for long-term investors.

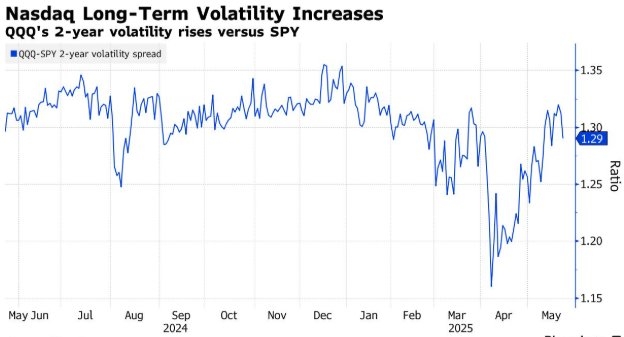

- Diversification: Investing in funeral stocks can help diversify your investment portfolio, as these stocks are not directly correlated with the stock market's volatility.

Case Studies

To illustrate the potential of funeral stocks, let's look at a few case studies:

- Service Corporation International (SCI): SCI is one of the largest providers of funeral, cremation, and cemetery services in the US. The company has a strong market position and a diverse portfolio of brands. Over the past few years, SCI has seen consistent growth, making it a solid investment choice.

- Carriage Services, Inc.: Carriage Services provides funeral, cremation, and cemetery services across the US. The company has a strong focus on customer service and has experienced significant growth in recent years.

Conclusion

In conclusion, funeral stocks are a growing trend in the US market, driven by the aging population and changing cultural attitudes towards death. Investing in funeral stocks can be a lucrative opportunity for long-term investors. As the demand for funeral services continues to rise, funeral stocks are expected to remain a stable and profitable investment option.

dow and nasdaq today