Fidelity US Large Cap Stock Fund: A Comprehensive Guide

author:US stockS -

Investing in the stock market can be a daunting task, especially when it comes to choosing the right funds. One such fund that has gained significant attention is the Fidelity US Large Cap Stock Fund. In this article, we will delve into the details of this fund, its performance, and how it can benefit investors looking to invest in large-cap stocks.

Understanding Fidelity US Large Cap Stock Fund

The Fidelity US Large Cap Stock Fund, as the name suggests, focuses on investing in large-cap stocks. Large-cap stocks are shares of companies with a market capitalization of over $10 billion. These companies are typically established, stable, and have a strong presence in the market.

The fund aims to achieve long-term capital appreciation by investing in a diversified portfolio of large-cap stocks across various sectors. This strategy helps in reducing risk and maximizing returns for investors.

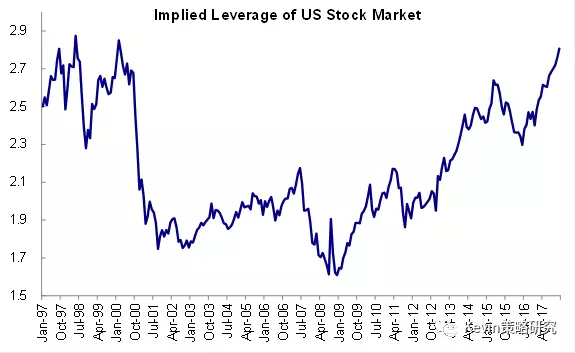

Performance of Fidelity US Large Cap Stock Fund

Over the years, the Fidelity US Large Cap Stock Fund has delivered impressive returns. As of the latest available data, the fund has outperformed its benchmark index, the S&P 500, on a consistent basis. This indicates that the fund has been able to generate higher returns for its investors.

Key Features of Fidelity US Large Cap Stock Fund

Diversification: The fund invests in a diverse range of large-cap stocks across various sectors, reducing the risk associated with investing in a single stock.

Professional Management: Fidelity, being one of the leading investment firms, ensures that the fund is managed by experienced professionals who have a deep understanding of the stock market.

Low Expense Ratio: The fund has a low expense ratio, which means a higher portion of your investment is used for generating returns rather than paying for management fees.

Tax-Efficient Investing: The fund offers tax-efficient investing, which helps in minimizing the tax burden on your investment returns.

Case Study: Investing in Fidelity US Large Cap Stock Fund

Let's consider a hypothetical scenario where an investor named John decides to invest

This example highlights the potential of investing in the Fidelity US Large Cap Stock Fund and how it can help investors achieve their financial goals.

Conclusion

The Fidelity US Large Cap Stock Fund is an excellent choice for investors looking to invest in large-cap stocks. Its impressive performance, low expense ratio, and professional management make it a compelling option. However, it's important to conduct thorough research and consult with a financial advisor before making any investment decisions.

dow and nasdaq today