Dow Jones Index Chart: A 5-Year Analysis

author:US stockS -

The Dow Jones Index has long been a barometer of the U.S. stock market's health. Over the past five years, this index has seen its fair share of ups and downs, reflecting the broader economic trends and market dynamics. In this article, we delve into a comprehensive analysis of the Dow Jones Index chart over the past five years, highlighting key trends, significant milestones, and potential future directions.

Understanding the Dow Jones Index

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 large, publicly-owned companies in the United States. These companies represent a diverse range of industries, including financials, technology, healthcare, and consumer goods. The index is widely regarded as a benchmark for the overall performance of the U.S. stock market.

Key Trends Over the Past 5 Years

Volatility in the Early Years: The first two years of the five-year period were marked by significant volatility. The market faced challenges such as trade tensions, geopolitical uncertainties, and the COVID-19 pandemic. Despite these headwinds, the Dow Jones Index managed to stay resilient.

Recovery and Growth: As the pandemic situation improved and economies started to recover, the Dow Jones Index experienced a strong rally. The index hit new record highs multiple times, reflecting the optimism in the market.

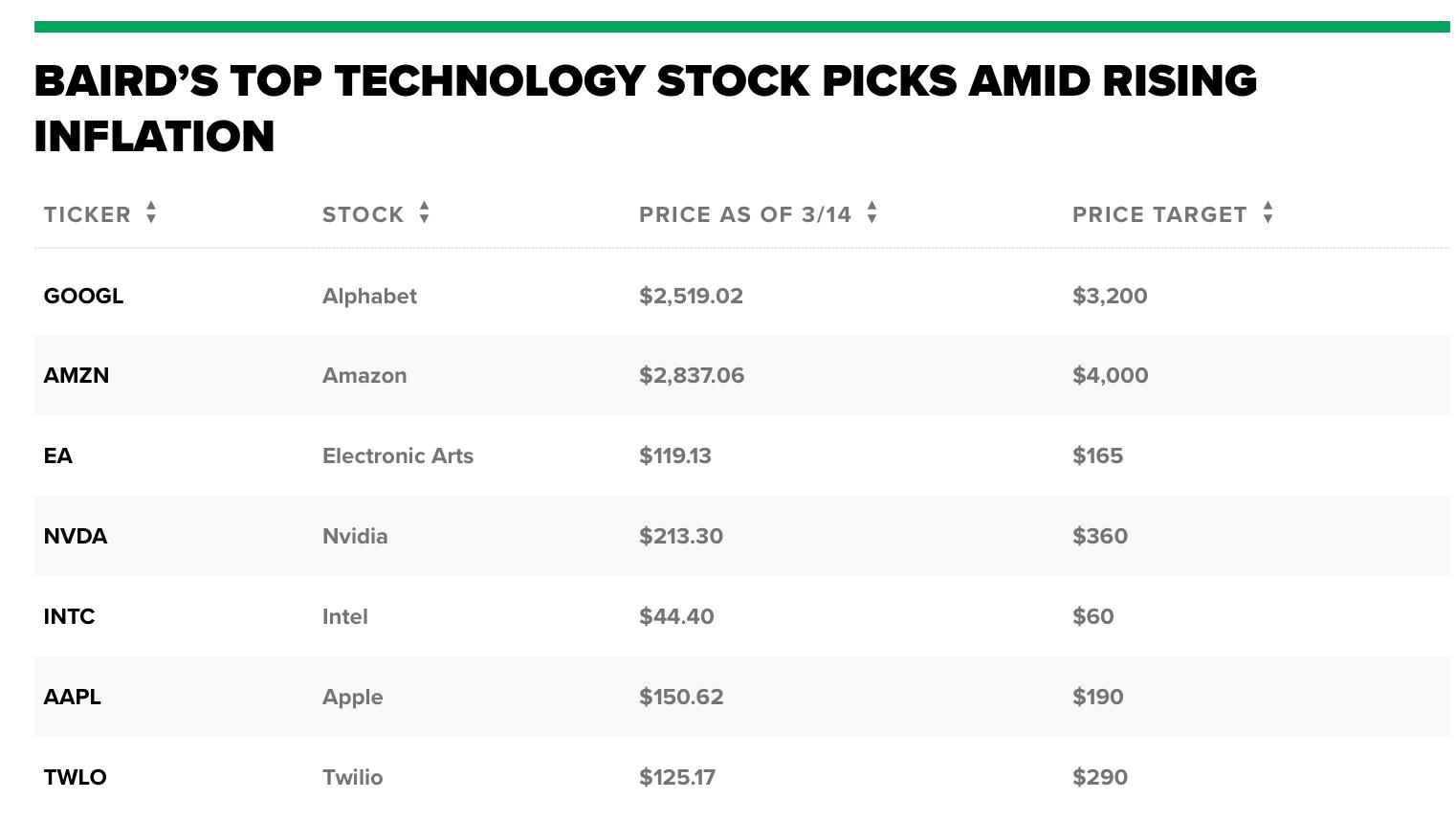

Tech Stocks Leading the Charge: Technology stocks, particularly giants like Apple, Microsoft, and Amazon, played a crucial role in driving the index higher. These companies have shown remarkable resilience and growth over the past few years.

Interest Rate Hikes and Market Corrections: The Federal Reserve's decision to raise interest rates in response to inflationary pressures led to market corrections. However, the Dow Jones Index quickly recovered, showing its resilience.

Significant Milestones

Record Highs: The Dow Jones Index hit several record highs over the past five years, reflecting the strong performance of the market.

COVID-19 Pandemic: The pandemic had a significant impact on the market, but the Dow Jones Index managed to recover and reach new highs.

Election of President Biden: The election of President Joe Biden in 2020 brought a sense of stability and optimism, which positively impacted the market.

Potential Future Directions

Economic Growth: As the economy continues to recover, the Dow Jones Index is likely to see further growth.

Inflation and Interest Rates: The Federal Reserve's policy on inflation and interest rates will be crucial in determining the market's future direction.

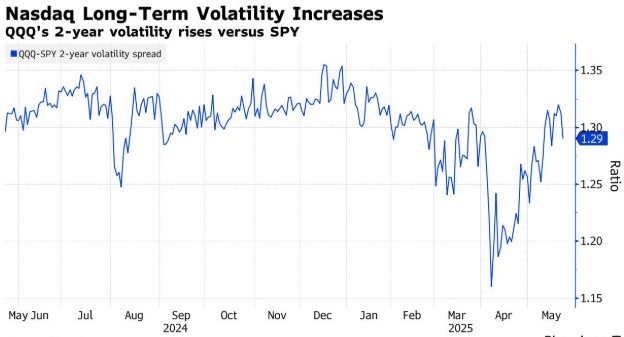

Tech Stocks: Technology stocks are expected to continue driving the index higher, but there may be some volatility.

Case Study: Apple's Impact on the Dow Jones Index

Apple, as one of the component stocks of the Dow Jones Index, has had a significant impact on its performance over the past five years. The company's strong financial performance and innovation have driven its stock price higher, contributing to the overall growth of the index.

In conclusion, the Dow Jones Index has experienced a remarkable journey over the past five years, reflecting the broader economic trends and market dynamics. As we move forward, the index's future direction will depend on various factors, including economic growth, inflation, and interest rates. However, one thing is clear: the Dow Jones Index remains a vital indicator of the U.S. stock market's health and potential.

dow and nasdaq today