Does the US Government Own Stock in Companies?

author:US stockS -

The U.S. government, as the largest shareholder in the world, has a significant presence in the stock market. This article delves into whether the U.S. government owns stock in companies, the types of investments it makes, and the implications of these investments.

Understanding Government Investments

The U.S. government's investment portfolio is vast and diverse. It includes stocks, bonds, and other financial instruments. The primary purpose of these investments is to manage the country's finances and ensure economic stability.

Types of Government Investments

Treasury Securities: The U.S. government issues Treasury securities, including bills, notes, and bonds, to finance its operations. These securities are considered low-risk investments and are often purchased by individuals, institutions, and foreign governments.

Federal Reserve Notes: The Federal Reserve, the central banking system of the United States, issues currency and coinage. While not technically stock, these notes are a form of investment in the government's ability to manage the economy.

Corporate Stocks: The U.S. government also owns stock in certain companies. This ownership is typically a result of government bailouts or investments in specific industries.

Government Bailouts and Stock Ownership

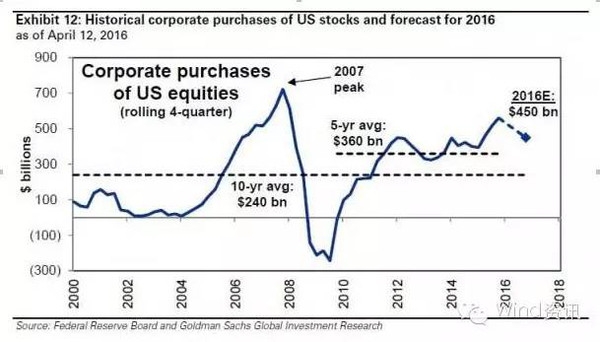

One of the most notable examples of the U.S. government owning stock in companies is the 2008 financial crisis. In response to the crisis, the government bailed out several major banks and auto manufacturers. As part of these bailouts, the government acquired shares of these companies, making it a shareholder.

For instance, the U.S. government acquired a significant stake in General Motors (GM) during the 2008 bailout. This investment helped stabilize the company and eventually led to its successful IPO in 2010. Similarly, the government also invested in banks like Bank of America and Citigroup.

Implications of Government Stock Ownership

The U.S. government's ownership of stock in companies has several implications:

Economic Influence: By owning shares in key industries, the government can exert economic influence and shape market trends.

Corporate Governance: The government's role as a shareholder also gives it the right to vote on corporate governance issues, such as board elections and executive compensation.

Tax Implications: The government's investment returns are subject to taxation, which can impact the overall budget.

Conclusion

In conclusion, the U.S. government does own stock in companies, primarily through Treasury securities, Federal Reserve notes, and corporate investments. These investments play a crucial role in managing the country's finances and ensuring economic stability. While the government's ownership of stock in companies has its implications, it remains an essential tool for economic management.

dow and nasdaq today