Did the US Federal Government Buy Stocks?

author:US stockS -

In the wake of the global financial crisis, many Americans wondered if the US Federal Government had ever bought stocks. This article delves into this intriguing question, providing insights into the government's role in the stock market and examining instances where such investments were made.

Understanding the US Federal Government's Role in the Stock Market

The primary role of the US Federal Government is to regulate and oversee the financial markets to ensure stability and prevent fraud. However, in certain circumstances, the government may choose to invest in stocks, either directly or indirectly.

Direct Investments

One of the most notable instances of the US Federal Government directly buying stocks was during the 2008 financial crisis. In response to the crisis, the government implemented the Troubled Asset Relief Program (TARP), which allocated $700 billion to stabilize the financial system. A portion of this funding was used to purchase shares in major banks and financial institutions, including Bank of America, Citigroup, and General Motors.

Indirect Investments

The government has also made indirect investments in the stock market through various programs. For example, the Federal Reserve has engaged in quantitative easing, which involves purchasing government securities and other financial assets to inject liquidity into the economy. This indirectly impacts the stock market by lowering interest rates and making stocks more attractive to investors.

The Impact of Government Investments on the Stock Market

The government's investment in stocks during the 2008 crisis was met with both praise and criticism. Proponents argued that these investments helped stabilize the financial system and prevent a complete collapse. Critics, however, contended that the government's intervention was a form of corporate welfare and could lead to moral hazard.

Case Studies

One of the most significant cases of the government buying stocks was the investment in General Motors. In 2009, the government provided GM with

Conclusion

While the US Federal Government has not made widespread investments in stocks, there have been notable instances where it has chosen to intervene. These investments, while controversial, have played a crucial role in stabilizing the financial system during times of crisis. As the government continues to navigate the complexities of the stock market, it remains to be seen how its role will evolve in the future.

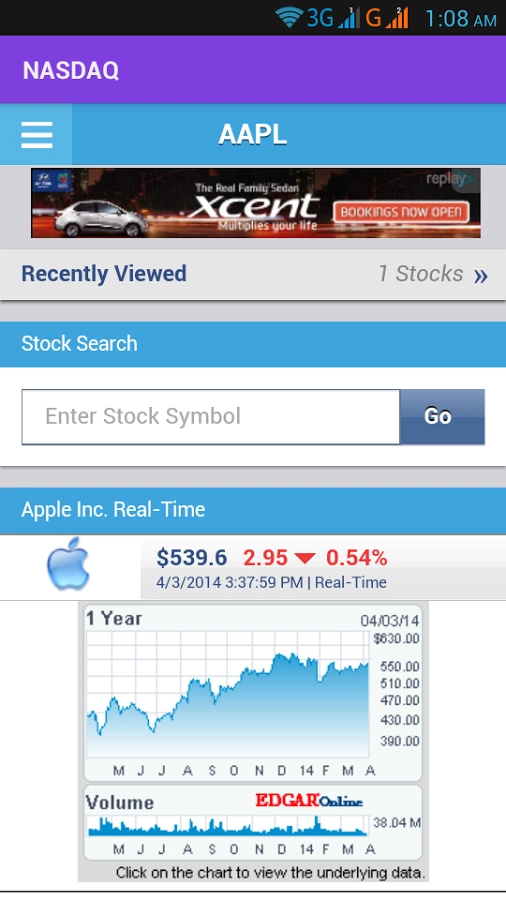

dow and nasdaq today