Brazilian Stocks: A Golden Opportunity for US Investors

author:US stockS -

Investing in Brazilian stocks has always been a topic of interest for US investors looking for new market opportunities. With the rapid growth of the Brazilian economy, now might be the perfect time to consider adding Brazilian stocks to your portfolio. This article will explore the potential of Brazilian stocks and how they can benefit US investors.

Understanding the Brazilian Stock Market

The Brazilian stock market, known as Bovespa, is the largest in Latin America and one of the top emerging markets globally. It has seen significant growth in recent years, thanks to the country's robust economic fundamentals. The Bovespa index includes a variety of sectors, such as energy, financials, and materials, making it an attractive investment destination.

Key Factors Driving Brazilian Stocks

1. Economic Growth

Brazil has experienced impressive economic growth over the past decade, driven by factors such as increased industrial production, infrastructure development, and a growing middle class. This growth has led to increased corporate profits and a surge in stock prices.

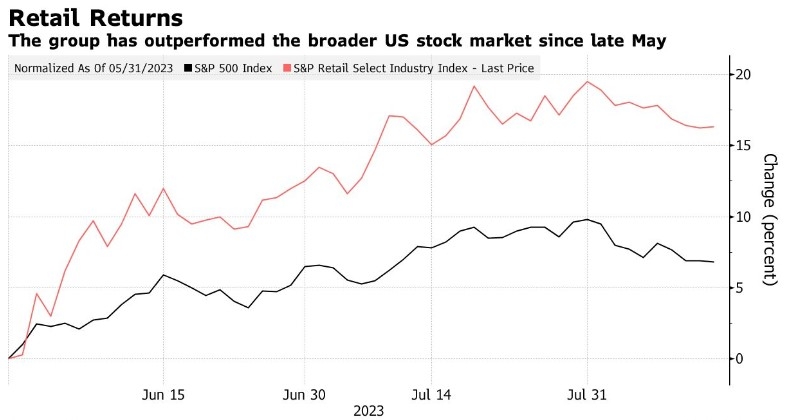

2. Low Correlation with US Markets

One of the key advantages of investing in Brazilian stocks is their low correlation with the US stock market. This means that when the US market is experiencing a downturn, Brazilian stocks may continue to perform well, providing diversification to your portfolio.

3. Diversification Opportunities

Brazil offers a diverse range of industries and companies, allowing US investors to gain exposure to different sectors. For example, the energy sector includes giants like Petrobras, which is one of the largest oil and gas companies in the world.

4. Tax Incentives

The Brazilian government has implemented various tax incentives to encourage foreign investment in the country. These incentives include reduced tax rates on dividends and capital gains for qualified investors.

How to Invest in Brazilian Stocks

US investors can invest in Brazilian stocks through a variety of channels, including:

- Brokerage Firms: Many brokerage firms offer access to Brazilian stocks, allowing investors to buy and sell shares directly.

- Exchange-Traded Funds (ETFs): ETFs are a convenient way to gain exposure to the Brazilian market without having to buy individual stocks.

- Mutual Funds: Some mutual funds focus on investing in Brazilian stocks, providing a diversified portfolio with professional management.

Case Studies

One notable example is the performance of Petrobras, the largest company listed on the Bovespa. Despite facing challenges such as political turmoil and falling oil prices, Petrobras has consistently delivered strong returns to investors over the long term.

Another example is Embraer, a leading aircraft manufacturer based in Brazil. Embraer has seen significant growth in its business, driven by increased demand for commercial and executive aircraft globally.

Conclusion

Investing in Brazilian stocks can be a valuable addition to a diversified portfolio. With the country's strong economic fundamentals and low correlation with the US market, now may be the right time to consider this emerging market. Be sure to do thorough research and consult with a financial advisor before making any investment decisions.

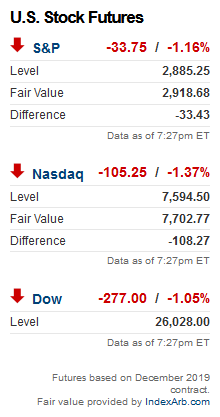

dow and nasdaq today