Best US Fracking Stocks: A Comprehensive Guide to Investment Opportunities

author:US stockS -

In the ever-evolving energy sector, hydraulic fracturing, or fracking, has emerged as a key technology for extracting oil and natural gas. As a result, investors are increasingly looking for the best US fracking stocks to capitalize on this growing industry. This article provides a comprehensive guide to identifying the top-performing fracking stocks in the United States.

Understanding Fracking Stocks

Fracking stocks are companies that are directly involved in the hydraulic fracturing process, which involves injecting water, sand, and chemicals into rock formations to release trapped oil and natural gas. These companies can range from large, diversified energy corporations to smaller, specialized firms.

Key Factors to Consider When Investing in Fracking Stocks

When selecting the best US fracking stocks, it's essential to consider several key factors:

- Market Capitalization: Larger companies with a higher market capitalization may offer more stability and liquidity, while smaller companies may offer higher growth potential.

- Production Volume: Look for companies with a strong track record of production growth and a diversified portfolio of assets.

- Technology and Innovation: Companies that invest in cutting-edge technology and innovation are more likely to remain competitive in the long term.

- Financial Health: Evaluate the financial health of the company, including its revenue, profit margins, and debt levels.

Top US Fracking Stocks to Watch

Based on these criteria, here are some of the best US fracking stocks to consider:

EQT Corporation (EQT)

- Market Capitalization: $21.5 billion

- Production Volume: 4.3 billion cubic feet per day

- Technology and Innovation: EQT has invested heavily in horizontal drilling and hydraulic fracturing technology, making it a leader in the industry.

Chesapeake Energy Corporation (CHK)

- Market Capitalization: $5.4 billion

- Production Volume: 3.2 billion cubic feet per day

- Financial Health: Chesapeake Energy has made significant strides in improving its financial health, reducing debt and increasing profitability.

Halliburton Company (HAL)

- Market Capitalization: $35.4 billion

- Technology and Innovation: Halliburton is a global leader in hydraulic fracturing technology and services, with a strong presence in the United States.

Baker Hughes Company (BHI)

- Market Capitalization: $15.1 billion

- Technology and Innovation: Baker Hughes offers a wide range of hydraulic fracturing services and technology solutions, making it a key player in the industry.

Crew Energy Inc. (CR)

- Market Capitalization: $1.2 billion

- Production Volume: 1.1 billion cubic feet per day

- Growth Potential: Crew Energy has experienced significant production growth and is well-positioned for future expansion.

Case Study: EQT Corporation

EQT Corporation is a prime example of a successful fracking stock. The company has invested heavily in horizontal drilling and hydraulic fracturing technology, which has allowed it to achieve significant production growth. In 2020, EQT's production volume increased by 5% year-over-year, driven by its focus on high-growth areas such as the Marcellus and Utica shales.

Conclusion

Investing in the best US fracking stocks can be a lucrative opportunity for investors looking to capitalize on the growing energy sector. By considering factors such as market capitalization, production volume, technology, and financial health, investors can identify the top-performing companies in the industry. As always, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

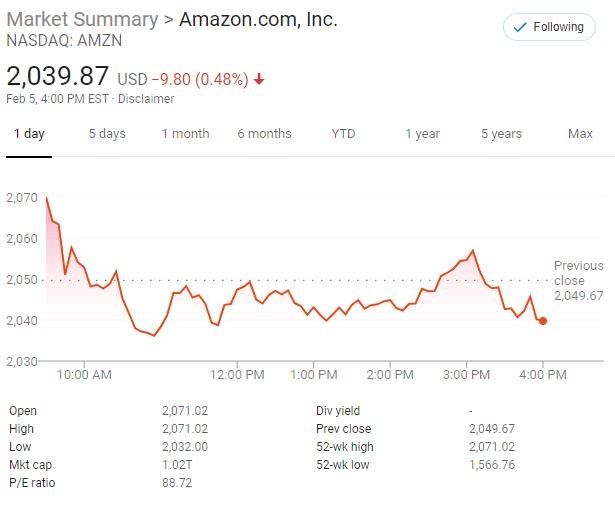

dow and nasdaq today