Barchart.com All US Mid Cap Stock Exchange: A Comprehensive Guide

author:US stockS -

In the vast landscape of the US stock market, mid-cap companies play a significant role in driving economic growth and providing investors with diverse opportunities. Barchart.com, a leading financial data provider, offers a comprehensive platform to explore the world of mid-cap stocks. This article delves into the details of Barchart's offerings, highlighting the key features and benefits of its US mid-cap stock exchange section.

Understanding Mid-Cap Stocks

Before we dive into Barchart.com, it's essential to understand what mid-cap stocks are. Mid-cap companies are generally defined as those with market capitalizations ranging from

Barchart.com: A Comprehensive Resource

Barchart.com is a one-stop-shop for financial data, providing users with access to a wide range of tools and resources. Its US mid-cap stock exchange section is particularly valuable for investors looking to explore and analyze mid-cap companies.

Key Features of Barchart's Mid-Cap Stock Exchange Section

In-depth Company Analysis: Barchart's platform offers detailed analysis of mid-cap companies, including financial statements, earnings reports, and industry comparisons. This allows investors to make informed decisions based on comprehensive data.

Interactive Charts: Users can visualize stock performance using interactive charts that offer various time frames, technical indicators, and drawing tools. This feature helps investors identify trends and make data-driven trading decisions.

Screeners: Barchart's stock screeners allow users to filter and sort mid-cap companies based on specific criteria, such as market capitalization, price-to-earnings ratio, and dividend yield. This makes it easier to find companies that match an investor's investment strategy.

News and Articles: Barchart provides up-to-date news and articles related to mid-cap companies, helping investors stay informed about market trends and company-specific developments.

Historical Data: Users can access historical data for mid-cap stocks, enabling them to analyze past performance and identify patterns.

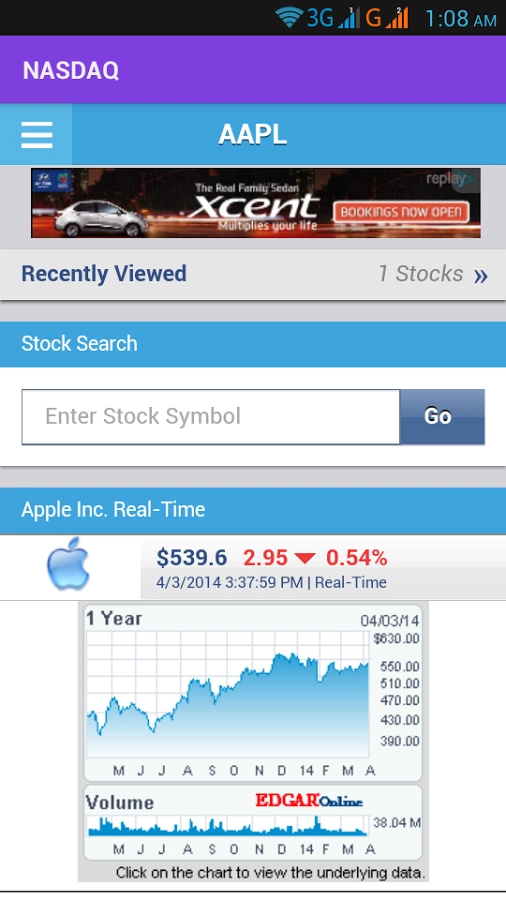

Case Study: Apple Inc. (AAPL)

To illustrate the value of Barchart's mid-cap stock exchange section, let's take a look at Apple Inc. (AAPL), a well-known mid-cap company that has grown into a large-cap giant.

Using Barchart's platform, investors can access detailed financial statements for Apple, including its income statement, balance sheet, and cash flow statement. They can also view interactive charts showing the stock's price history and technical indicators, such as moving averages and RSI.

By analyzing this data, investors can gain insights into Apple's financial health, growth potential, and market trends. For example, they may notice that Apple's stock has been trending upwards over the past year, indicating strong performance and potential for future growth.

Conclusion

Barchart.com's US mid-cap stock exchange section is an invaluable resource for investors looking to explore and analyze mid-cap companies. With its comprehensive data, interactive tools, and in-depth analysis, Barchart.com provides a platform for making informed investment decisions. Whether you're a seasoned investor or just starting out, Barchart.com is a must-have tool for navigating the world of mid-cap stocks.

dow and nasdaq today