Are U.S. Stocks Crashing? A Comprehensive Analysis

author:US stockS -

Introduction

The stock market is a reflection of the economic pulse of a nation. As such, it's no surprise that investors are buzzing with questions about whether the U.S. stock market is crashing. In this article, we delve into the current state of the market, potential causes of any crash, and what investors should be aware of.

Understanding the Current Market State

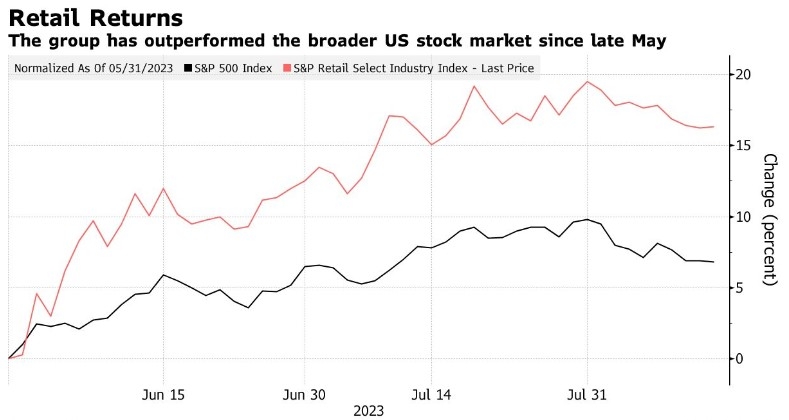

As of early 2023, the U.S. stock market has experienced significant volatility. While the S&P 500 index has seen periods of growth, it has also seen sharp declines. This volatility can be attributed to a variety of factors, including geopolitical tensions, rising inflation, and economic uncertainty.

Geopolitical Tensions

Geopolitical tensions have been a major factor contributing to market volatility. The ongoing conflict in Eastern Europe, along with tensions in the Middle East, have raised concerns about global stability. These tensions have led to increased demand for safe-haven assets, such as gold and U.S. Treasuries, which has put downward pressure on stocks.

Rising Inflation

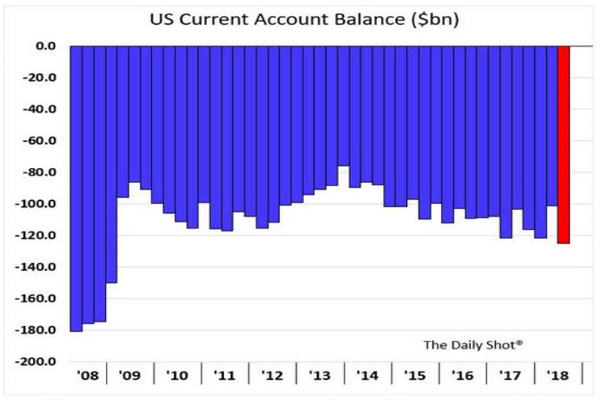

Rising inflation has also been a significant concern for investors. The Federal Reserve has been raising interest rates in an attempt to control inflation, which has led to higher borrowing costs for companies and consumers. This has created uncertainty in the market, as investors try to predict the future direction of the economy.

Economic Uncertainty

The global economy is facing a number of uncertainties, including the ongoing COVID-19 pandemic, supply chain disruptions, and the potential for a global recession. These uncertainties have created a volatile environment for stocks, as investors are cautious about making long-term investment decisions.

Potential Causes of a Stock Market Crash

While the current market conditions are concerning, it's important to note that a full-blown crash is not inevitable. However, there are several potential causes that investors should be aware of:

- Economic Recession: A recession could lead to a significant drop in stock prices as companies struggle with reduced consumer demand and increased costs.

- Market Manipulation: Market manipulation, such as insider trading or false information, can lead to rapid and unpredictable market movements.

- Extreme Market Volatility: Sudden and dramatic changes in market sentiment can lead to rapid price declines.

What Investors Should Do

If the U.S. stock market is crashing, investors should consider the following steps:

- Review Your Portfolio: Assess your investments and determine if any adjustments are necessary.

- Diversify Your Investments: Diversification can help reduce the impact of market volatility on your portfolio.

- Stay Informed: Keep up with market news and economic indicators to stay informed about potential risks and opportunities.

Conclusion

While the current market conditions are concerning, it's important to remember that the stock market has experienced volatility before and has always recovered. By staying informed, diversifying your investments, and maintaining a long-term perspective, you can navigate the current market environment with confidence.

dow and nasdaq today