Analyst Upgrades US Stocks: Recent Trends and Implications

author:US stockS -

In the ever-evolving world of finance, it's crucial to stay ahead of the curve. Recent upgrades by market analysts on US stocks have sparked a wave of optimism among investors. This article delves into the recent trends and implications of these upgrades, highlighting key sectors and individual stocks that have caught the eyes of experts.

Understanding the Analyst Upgrades

Analyst upgrades occur when financial experts revise their outlook on a particular stock from negative or neutral to positive. This shift is typically based on several factors, including improved financial performance, positive industry trends, or a favorable market outlook.

Top Sectors and Stocks

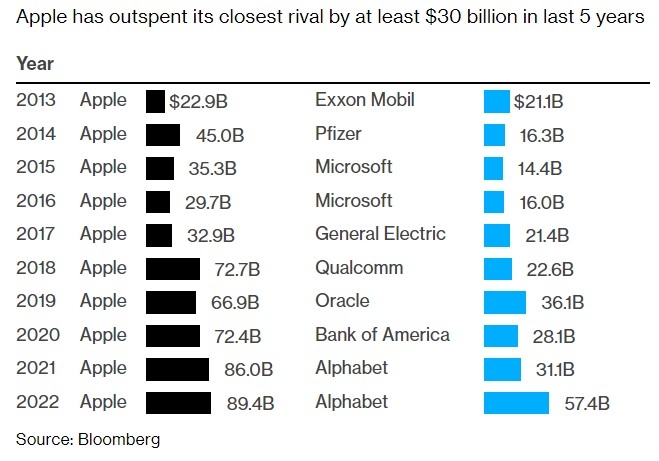

Technology Stocks: The technology sector has been a major beneficiary of recent analyst upgrades. Companies like Apple and Microsoft have seen their stock ratings improved due to strong revenue growth and a robust outlook for the future. Analysts are particularly optimistic about the growth potential in areas such as cloud computing and artificial intelligence.

Healthcare Stocks: The healthcare sector has also seen a surge in upgrades, with companies like Johnson & Johnson and Merck leading the charge. Analysts are upbeat about the sector's long-term prospects, driven by an aging population and increasing demand for healthcare services.

Energy Stocks: The energy sector has experienced a significant turnaround, with several companies receiving analyst upgrades. Companies like ExxonMobil and Chevron have seen their stock ratings improved due to rising oil prices and increased production levels.

Implications of Analyst Upgrades

Investor Sentiment: Analyst upgrades can significantly impact investor sentiment. When experts express optimism about a particular stock or sector, it can attract new investors and lead to increased demand for those stocks, potentially driving up prices.

Market Trends: Analyst upgrades can also provide valuable insights into market trends. By identifying sectors and stocks that are receiving positive ratings, investors can gain a better understanding of where the market is heading.

Risk Management: Analyst upgrades can also help investors manage their risk. By diversifying their portfolios with stocks that have received positive ratings, investors can potentially reduce their exposure to market volatility.

Case Study: Apple

One notable case study is Apple, which has seen its stock rating upgraded by several analysts. The company's strong financial performance, particularly in areas such as services and hardware, has been a key driver of this optimism. Analysts believe that Apple's robust product lineup and strong brand loyalty will continue to drive growth in the coming years.

Conclusion

In conclusion, recent analyst upgrades on US stocks have provided valuable insights into market trends and potential investment opportunities. By staying informed about these upgrades and their implications, investors can make more informed decisions and potentially benefit from the market's upward momentum.

dow and nasdaq today