11 US Stock Market Sectors: A Comprehensive Guide

author:US stockS -

In the vast landscape of the US stock market, understanding the different sectors is crucial for investors seeking to diversify their portfolios. This article delves into the 11 primary sectors, providing an in-depth look at each to help you make informed investment decisions.

1. Communication Services

The Communication Services sector includes companies involved in the provision of various communication services, such as broadcasting, telecommunications, and internet services. Key players in this sector include Facebook, Amazon, and AT&T. These companies are often at the forefront of technological advancements and play a significant role in shaping the digital landscape.

2. Consumer Discretionary

The Consumer Discretionary sector encompasses companies that produce goods and services that are not essential for day-to-day living. This includes industries such as automotive, retail, entertainment, and home furnishings. Companies like Tesla, NVIDIA, and Walmart are prominent players in this sector.

3. Consumer Staples

In contrast to the Consumer Discretionary sector, the Consumer Staples sector includes companies that produce goods and services that are considered essential for daily living. This sector includes industries such as food and beverage, personal products, and pharmaceuticals. Key players include Procter & Gamble, Coca-Cola, and Pfizer.

4. Energy

The Energy sector covers companies involved in the exploration, production, and distribution of energy resources. This includes both traditional energy sources such as oil and gas, as well as renewable energy sources like solar and wind power. Notable companies in this sector include ExxonMobil, Chevron, and BP.

5. Financials

The Financials sector includes companies involved in the provision of financial services, such as banking, insurance, and investment management. This sector is highly diversified and includes companies like JPMorgan Chase, Goldman Sachs, and Prudential Financial.

6. Health Care

The Health Care sector includes companies involved in the provision of health care services and products. This sector is divided into two sub-sectors: Health Care Equipment & Supplies and Health Care Services. Notable companies include Johnson & Johnson, Medtronic, and Walmart (through its pharmacy division).

7. Information Technology

The Information Technology sector includes companies involved in the development, manufacturing, and distribution of computer hardware, software, and related services. Key players in this sector include Apple, Microsoft, and Intel.

8. Industrials

The Industrials sector includes companies involved in the manufacturing and provision of industrial goods and services. This sector is highly diverse and includes industries such as aerospace and defense, construction, and transportation. Prominent companies include Boeing, General Electric, and Caterpillar.

9. Materials

The Materials sector includes companies involved in the production of raw materials and semi-finished goods. This sector includes industries such as mining, chemicals, and construction materials. Key players include BHP Billiton, Vale, and PPG Industries.

10. Real Estate

The Real Estate sector includes companies involved in the ownership, development, and management of real estate properties. This sector is divided into two sub-sectors: Real Estate Operations and Real Estate Investment Trusts (REITs). Notable companies include Vornado Realty Trust, Simon Property Group, and Public Storage.

11. Utilities

The Utilities sector includes companies involved in the generation, transmission, and distribution of electricity, natural gas, and water. This sector is known for its stability and predictable cash flows. Key players include Exelon Corporation, Duke Energy, and NextEra Energy.

Understanding the 11 primary sectors of the US stock market can help investors make informed decisions and diversify their portfolios effectively. By analyzing the unique characteristics and performance trends of each sector, investors can identify opportunities and mitigate risks in their investment strategies.

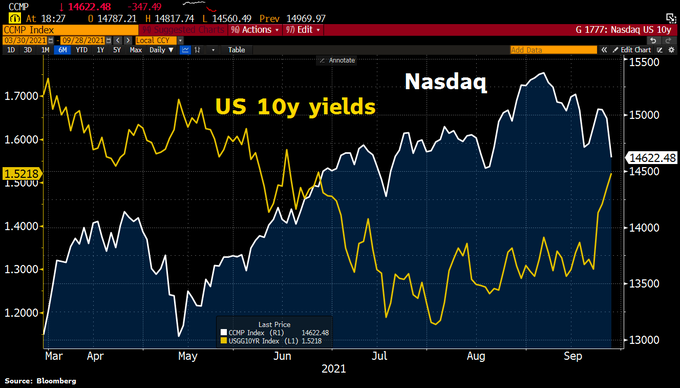

dow and nasdaq today