nasdaq 100 performance

author:US stockS -performance(1)100(15)nasdaq(250)Underst(5)

Understanding the NASDAQ 100 Performance: A Comprehensive Guide

The NASDAQ 100, a widely followed index of the top 100 non-financial companies listed on the NASDAQ, serves as a key indicator of the tech and growth sectors of the U.S. stock market. This article delves into the performance of the NASDAQ 100, analyzing its historical trends, recent developments, and future prospects.

Historical Performance

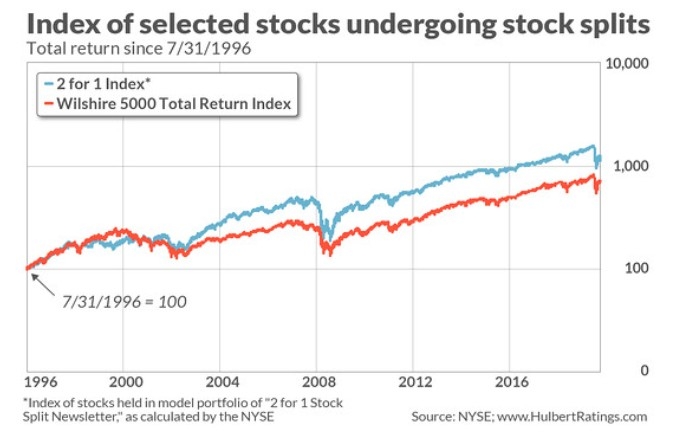

The NASDAQ 100 has historically outperformed other major stock market indices, such as the S&P 500, due to its concentration in tech and growth sectors. Over the past two decades, the index has seen significant growth, with the highest returns coming from companies like Apple, Microsoft, and Amazon.

Recent Developments

In recent years, the NASDAQ 100 has faced various challenges, including the global financial crisis of 2008, the dot-com bubble burst of 2000, and the COVID-19 pandemic. Despite these challenges, the index has shown remarkable resilience, with strong recoveries following each downturn.

One of the key factors contributing to the NASDAQ 100's recent performance has been the increasing adoption of technology in various industries. This has led to significant growth for companies like Tesla, Netflix, and Facebook (now Meta). Additionally, the rise of remote work and online learning has further boosted the performance of tech companies within the index.

Sector Performance

The NASDAQ 100 is divided into several sectors, including technology, telecommunications, healthcare, and consumer discretionary. Among these sectors, technology has been the most significant contributor to the index's performance. Companies like Apple, Microsoft, and NVIDIA have consistently outperformed their peers, driving the overall index higher.

In contrast, the healthcare sector has also performed well, with companies like Pfizer and Johnson & Johnson contributing positively to the index. However, the consumer discretionary sector has faced challenges, with companies like Netflix and Disney experiencing declining performance.

Future Prospects

Looking ahead, the future of the NASDAQ 100 appears promising, with several factors driving its potential growth. First, the increasing demand for technology in various industries is expected to continue, with companies like Apple and Microsoft likely to maintain their leadership positions. Second, the rise of 5G technology is expected to revolutionize the telecommunications sector, with companies like AT&T and Verizon poised to benefit.

Furthermore, the healthcare sector is expected to see significant growth, driven by advancements in biotechnology and pharmaceuticals. Companies like Amgen and Regeneron are likely to contribute positively to the index.

Case Studies

To illustrate the performance of the NASDAQ 100, let's consider a few case studies:

- Apple: Since its initial public offering in 1980, Apple has seen remarkable growth, with its stock price increasing by over 100,000%. This has significantly contributed to the overall performance of the NASDAQ 100.

- Tesla: Since its inception in 2003, Tesla has become one of the most valuable companies in the world, with its stock price skyrocketing. This has had a substantial impact on the NASDAQ 100's performance.

- Meta (formerly Facebook): Despite facing criticism and regulatory challenges, Meta has continued to grow, with its stock price experiencing significant gains. This has contributed positively to the NASDAQ 100's performance.

In conclusion, the NASDAQ 100 has proven to be a robust indicator of the tech and growth sectors of the U.S. stock market. Its historical performance, recent developments, and future prospects make it a key index to watch for investors seeking exposure to the technology and growth sectors.

us stock market today live cha