Understanding the Jets ETF Share Price: A Comprehensive Guide

author:US stockS -Investing in Exchange Traded Funds (ETFs) has become a popular choice among investors seeking diversification and liquidity. One such ETF that has caught the attention of many is the Jets ETF. In this article, we will delve into the share price of the Jets ETF, its factors influencing it, and how investors can make informed decisions.

What is the Jets ETF?

The Jets ETF, officially known as the Global X Airlines ETF (NYSEARCA:JETS), is designed to track the performance of the Dow Jones U.S. Select Airlines Index. This index includes a basket of U.S.-listed airlines and aerospace companies, aiming to provide exposure to the airline industry's growth potential.

Factors Influencing the Jets ETF Share Price

Economic Conditions: The airline industry is highly sensitive to economic fluctuations. During economic downturns, travel demand tends to decline, affecting airline revenues and ultimately the ETF's share price. Conversely, during economic upswings, travel demand increases, positively impacting the ETF's share price.

Fuel Prices: Fuel costs are a significant expense for airlines. Fluctuations in oil prices can directly impact airline profitability and, subsequently, the ETF's share price. Higher fuel prices can lead to increased operating costs, while lower fuel prices can boost airline profits.

Regulatory Changes: Changes in aviation regulations can have a substantial impact on the airline industry. For instance, stricter emissions regulations or increased security measures can lead to increased costs for airlines, potentially affecting the ETF's share price.

Market Sentiment: Investor sentiment towards the airline industry can significantly influence the ETF's share price. Positive news, such as a merger announcement or a successful expansion, can boost investor confidence and drive up the ETF's share price. Conversely, negative news, such as a safety incident or a labor dispute, can lead to a decline in the ETF's share price.

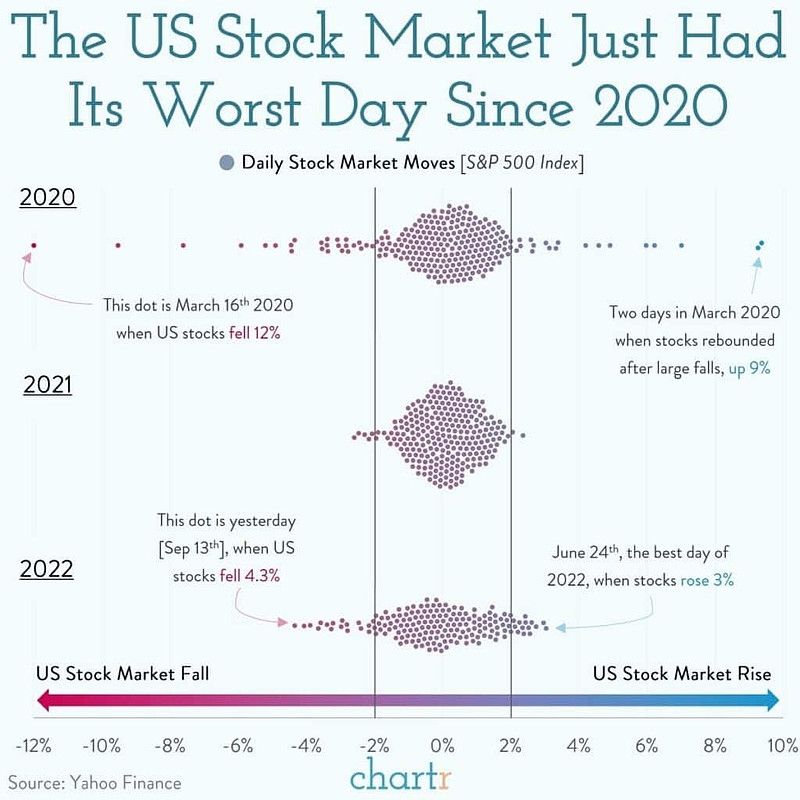

Global Events: Global events, such as pandemics or geopolitical tensions, can have a significant impact on the airline industry. For example, the COVID-19 pandemic led to a significant decline in air travel, negatively affecting the ETF's share price.

Case Study: Impact of the Pandemic on the Jets ETF

The COVID-19 pandemic had a profound impact on the airline industry and, consequently, the Jets ETF. During the pandemic, travel demand plummeted, leading to reduced revenue and increased costs for airlines. As a result, the ETF's share price experienced a sharp decline. However, as travel demand began to recover, the ETF's share price started to rise again.

Investing in the Jets ETF

Investing in the Jets ETF requires careful consideration of the factors influencing its share price. Investors should conduct thorough research and stay updated on market trends and economic conditions. Additionally, diversifying their portfolio can help mitigate risks associated with investing in a single sector.

Conclusion

Understanding the Jets ETF share price requires a comprehensive understanding of the factors influencing it. By staying informed and making informed decisions, investors can capitalize on the growth potential of the airline industry through the Jets ETF.

us stock market today live cha