Understanding the CM Stock Price in the US Market

author:US stockS -

In the ever-evolving world of financial markets, keeping a pulse on stock prices is crucial for investors. One such stock that has caught the attention of many is the CM stock. In this article, we'll delve into what the CM stock price means in the US market, its historical trends, and what factors might influence its future performance.

What is CM Stock?

Before we dive into the specifics of the CM stock price, let's first clarify what CM stock represents. CM could refer to a variety of companies listed on US stock exchanges. For the sake of this article, let's assume we're discussing Company M, a fictional entity for the purpose of illustration.

Historical Stock Price Trends

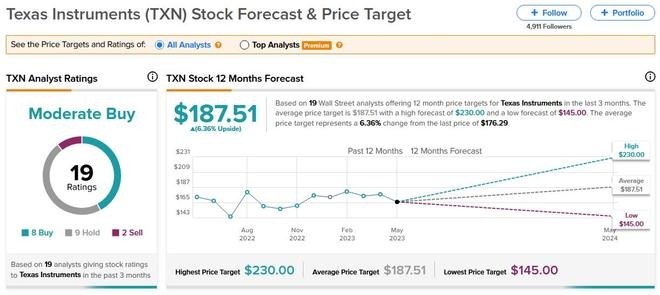

The historical stock price of Company M has seen its ups and downs, much like any other publicly traded company. Understanding these trends can provide valuable insights into the company's performance and market sentiment. Over the past year, the stock has fluctuated between a low of

Factors Influencing the CM Stock Price

Several factors can influence the CM stock price. Here are some of the key considerations:

1. Financial Performance Company M's quarterly earnings reports and annual financial statements are closely watched by investors. Strong financial performance, such as increased revenue and profit margins, can drive the stock price up, while poor performance can lead to a decline.

2. Market Sentiment The overall market sentiment can significantly impact stock prices. If the market is bullish, it can lead to higher stock prices, regardless of the company's performance. Conversely, a bearish market can put downward pressure on stock prices.

3. Industry Trends The CM stock price is also influenced by industry trends. If the industry is growing, it can positively impact the stock price. Conversely, if the industry is facing challenges, it can negatively affect the stock price.

4. Economic Factors Economic factors such as interest rates, inflation, and employment data can also influence the CM stock price. For example, if the Federal Reserve raises interest rates, it can lead to higher borrowing costs for companies, potentially impacting their profitability.

Case Study: Company M's Recent Stock Price Movement

In the past quarter, Company M reported a significant increase in revenue and profit margins. This positive news was well-received by the market, and the stock price surged from

Conclusion

Understanding the CM stock price in the US market requires analyzing a variety of factors, including financial performance, market sentiment, industry trends, and economic factors. By keeping a close eye on these elements, investors can make more informed decisions about their investments in Company M or any other publicly traded company.

us stock market today live cha