Non-Resident Investing in US Stocks: A Comprehensive Guide

author:US stockS -

Investing in US stocks can be an attractive opportunity for non-residents seeking to diversify their portfolios and capitalize on the robust American economy. However, navigating the complexities of international investing can be daunting. This article provides a comprehensive guide to help non-residents understand the process of investing in US stocks, including the necessary steps, considerations, and potential benefits.

Understanding Non-Resident Investing

What is a Non-Resident Investor? A non-resident investor is anyone who is not a citizen or legal resident of the United States. This includes individuals, corporations, and other entities located outside the United States. Non-residents can invest in US stocks through various means, such as brokerage accounts, mutual funds, and exchange-traded funds (ETFs).

Steps to Invest in US Stocks

1. Open a Brokerage Account

The first step for non-residents is to open a brokerage account with a reputable brokerage firm that offers international services. Many well-known brokerage firms, such as Charles Schwab, Fidelity, and TD Ameritrade, cater to non-resident investors.

Key Considerations:

- Ensure the brokerage firm is authorized to conduct business with non-residents.

- Research the fees and minimum investment requirements.

- Verify the brokerage firm's reputation and customer service.

2. Understand Tax Implications

Non-residents investing in US stocks are subject to certain tax regulations. It's crucial to understand the tax implications to avoid potential penalties and legal issues.

Tax Considerations:

- Withholding Tax: Non-residents are subject to a 30% withholding tax on dividends and interest earned from US stocks.

- Capital Gains Tax: Non-residents may be subject to capital gains tax on the sale of US stocks, depending on the duration of ownership and the country of residence.

- Tax Treaty: Check if there is a tax treaty between the investor's country and the United States, which may reduce or eliminate the withholding tax.

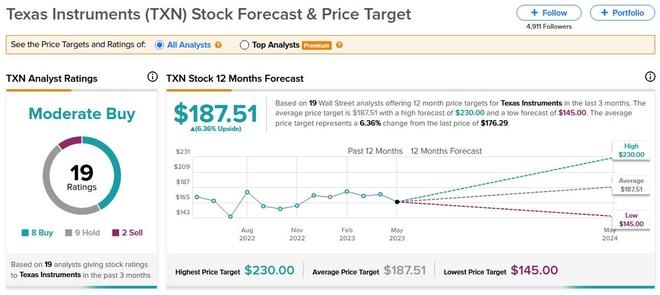

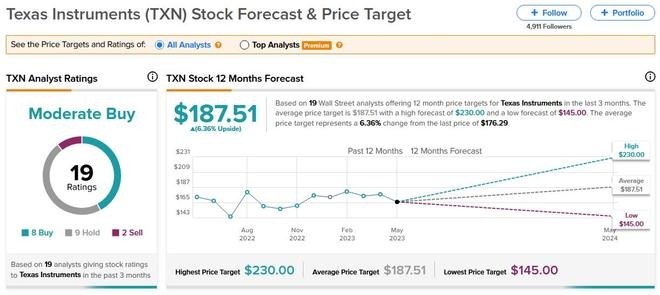

3. Research and Select Stocks

Once the brokerage account is set up, it's time to research and select stocks to invest in. Consider the following factors:

- Market Performance: Analyze the historical performance of the stock and its industry.

- Financial Health: Evaluate the company's financial statements, including revenue, profit margins, and debt levels.

- Dividend Yield: Consider the dividend yield if the goal is to generate income from the investment.

Potential Benefits of Investing in US Stocks

Investing in US stocks offers several benefits for non-residents:

- Diversification: Investing in US stocks can help diversify a portfolio, reducing exposure to domestic market risks.

- Access to Leading Companies: The US stock market is home to many of the world's largest and most successful companies.

- Potential for High Returns: The US stock market has historically provided high returns, making it an attractive investment destination.

Case Study: Investing in Apple Inc.

Consider the case of a non-resident investor from Germany who decides to invest in Apple Inc. (AAPL) through a brokerage account. The investor conducts thorough research on Apple's financial health and market performance, and decides to purchase 100 shares of Apple stock at $150 per share.

After a few years, the investor decides to sell the shares when the stock price reaches

Conclusion

Investing in US stocks can be a rewarding opportunity for non-residents. By understanding the necessary steps, tax implications, and potential benefits, non-residents can make informed investment decisions and achieve their financial goals.

us stock market today live cha