Foreigner Invest in US Stock: A Comprehensive Guide

author:US stockS -

Are you a foreign investor considering venturing into the U.S. stock market? You've come to the right place! Investing in U.S. stocks can be a lucrative opportunity, but it's crucial to understand the ins and outs of the process. In this comprehensive guide, we'll explore the key factors to consider when investing in U.S. stocks as a foreigner, including the benefits, risks, and the steps to get started.

Understanding the U.S. Stock Market

The U.S. stock market is one of the most dynamic and diverse in the world. It's home to numerous well-established companies, as well as emerging startups. As a foreign investor, you can gain access to this market through various investment vehicles, such as stocks, ETFs, and mutual funds.

Benefits of Investing in U.S. Stocks

- Strong Economic Growth: The U.S. has a robust economy with a strong history of growth, making it an attractive destination for foreign investors.

- Diverse Investment Opportunities: The U.S. stock market offers a wide range of sectors and industries, allowing you to diversify your portfolio.

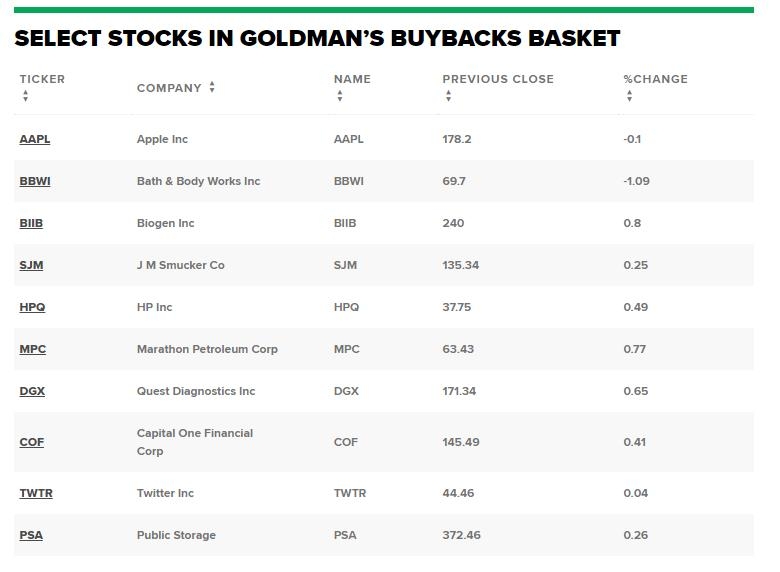

- Access to World-Class Companies: You can invest in some of the most renowned companies globally, such as Apple, Google, and Microsoft.

- Potential for High Returns: The U.S. stock market has historically provided higher returns than many other markets, making it an appealing investment option.

Risks of Investing in U.S. Stocks

While investing in U.S. stocks offers numerous benefits, it's important to be aware of the risks involved:

- Market Volatility: The stock market can be unpredictable, with prices fluctuating rapidly.

- Currency Risk: If you're investing in U.S. stocks with a foreign currency, exchange rate fluctuations can impact your returns.

- Political and Economic Risk: Changes in the political and economic landscape can affect the performance of U.S. stocks.

Steps to Invest in U.S. Stocks as a Foreigner

- Open a Brokerage Account: To invest in U.S. stocks, you'll need to open a brokerage account with a reputable firm. Ensure that the brokerage is regulated and has a good reputation.

- Understand the Tax Implications: Be aware of the tax implications of investing in U.S. stocks as a foreigner. Consult with a tax professional to ensure compliance with applicable tax laws.

- Research and Analyze: Conduct thorough research on the companies and sectors you're interested in. Utilize financial websites, reports, and news to stay informed.

- Diversify Your Portfolio: Diversify your investments to minimize risk. Consider investing in different sectors, industries, and geographical regions.

- Stay Informed: Keep up with market trends, economic news, and company developments to make informed investment decisions.

Case Study: Investing in U.S. Stocks as a Foreigner

Consider the case of Sarah, a German investor who decided to invest in U.S. stocks. After opening a brokerage account with a reputable firm, Sarah conducted thorough research on various companies in the technology sector. She decided to invest in Apple, Google, and Microsoft, diversifying her portfolio. Over the next five years, her investments in U.S. stocks grew significantly, outperforming her initial expectations.

Conclusion

Investing in U.S. stocks as a foreigner can be a rewarding experience, provided you understand the risks and take the necessary precautions. By following the steps outlined in this guide, you can navigate the U.S. stock market with confidence and potentially achieve substantial returns.

us stock market today live cha