Dow Jones Completion Index: A Comprehensive Guide

author:US stockS -

In the ever-evolving world of financial markets, staying ahead of the curve is crucial for investors. One tool that has gained significant attention is the Dow Jones Completion Index. This index is a vital indicator for those looking to gauge the overall health of the market. In this article, we will delve into what the Dow Jones Completion Index is, how it works, and its significance in the financial world.

Understanding the Dow Jones Completion Index

The Dow Jones Completion Index is a market index that tracks the performance of a basket of stocks. It is designed to provide a comprehensive view of the market's overall health by including a diverse range of companies across various sectors. Unlike the more widely-known Dow Jones Industrial Average, which only includes 30 companies, the Completion Index covers a broader spectrum of the market.

How the Dow Jones Completion Index Works

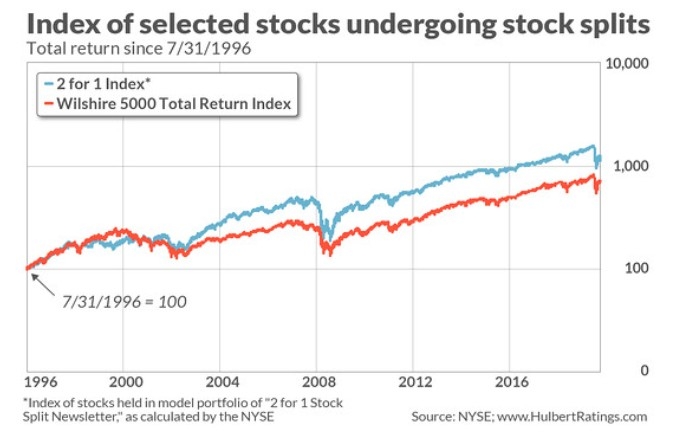

The Dow Jones Completion Index is calculated by taking the average price of the selected stocks and adjusting it for any splits, dividends, and other corporate actions. This index is a price-weighted index, meaning that stocks with higher prices have a greater impact on the index's value.

The Significance of the Dow Jones Completion Index

The Dow Jones Completion Index is a valuable tool for investors for several reasons:

- Comprehensive Market View: By including a wide range of companies, the index provides a more holistic view of the market's performance. This can help investors make more informed decisions based on a broader perspective.

- Sector Analysis: The index includes companies from various sectors, allowing investors to analyze the performance of different industries and identify potential opportunities.

- Historical Performance: The index has a long history, making it a reliable indicator of market trends over time.

Case Study: The Impact of the Dow Jones Completion Index on Investment Decisions

Let's consider a hypothetical scenario. An investor is analyzing the market and looking for opportunities. By examining the Dow Jones Completion Index, they notice that the index has been steadily rising over the past few months. This indicates a strong overall market performance and suggests that it may be a good time to invest.

By further analyzing the index, the investor identifies sectors that are performing particularly well. They decide to allocate a portion of their portfolio to these sectors, potentially leading to significant returns.

Conclusion

The Dow Jones Completion Index is a powerful tool for investors looking to gain insights into the overall health of the market. By providing a comprehensive view of the market's performance and including a diverse range of companies, this index can help investors make more informed decisions and identify potential opportunities. Whether you are a seasoned investor or just starting out, understanding the Dow Jones Completion Index can give you a competitive edge in the financial markets.

us stock market today live cha