Buying US Stocks from Australia: A Comprehensive Guide

author:US stockS -

Are you an Australian investor looking to expand your portfolio by investing in US stocks? With the global market becoming increasingly interconnected, accessing US stocks from Australia has never been easier. This guide will provide you with valuable insights on how to buy US stocks, the benefits of doing so, and key considerations to keep in mind.

Understanding the Process

Buying US stocks from Australia involves a few straightforward steps. Here's a breakdown:

Open a brokerage account: To invest in US stocks, you need to open a brokerage account with a firm that offers international trading services. Popular brokers in Australia include e*TRADE, Interactive Brokers, and Fidelity.

Research and select stocks: Once your brokerage account is set up, research companies that interest you. Look for strong fundamentals, a solid business model, and a positive outlook for future growth.

Fund your account: Transfer funds from your Australian bank account to your brokerage account. This can be done via wire transfer or an electronic funds transfer.

Place your order: Using your brokerage platform, place an order to buy the desired US stocks. You can choose to buy stocks on a "market" or "limit" basis, depending on your investment strategy.

Benefits of Buying US Stocks from Australia

Investing in US stocks from Australia offers several advantages:

Diversification: By adding US stocks to your portfolio, you can diversify your investments across different markets and sectors, reducing your exposure to any single country's economic risks.

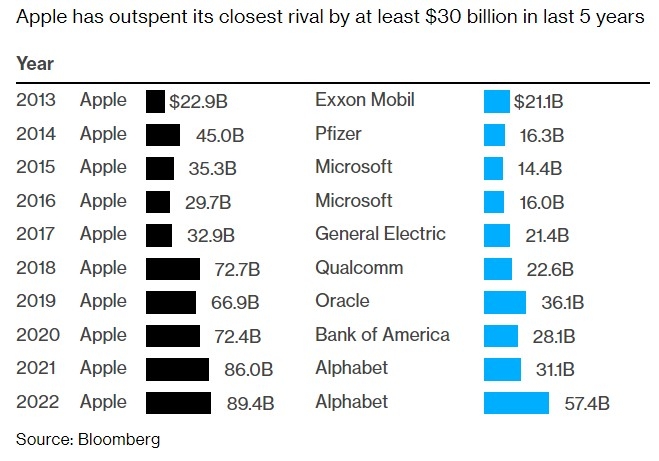

Access to Top Companies: The US is home to some of the world's largest and most successful companies, such as Apple, Amazon, and Google. Investing in these companies can provide access to strong growth potential and dividends.

Currency Conversion: When buying US stocks, you'll be dealing in US dollars. This can be beneficial if you believe the Australian dollar will strengthen against the US dollar in the future.

Key Considerations

Before diving into US stock investing, consider the following factors:

Transaction Costs: Be aware of any fees associated with buying US stocks, such as brokerage commissions, currency conversion fees, and tax implications.

Time Zone Differences: Be mindful of the time difference between Australia and the US when placing orders, as market hours differ.

Regulatory Requirements: Ensure you comply with Australian and US regulatory requirements for investing in international stocks.

Case Study: Investing in Apple from Australia

Let's say you've done your research and decided to invest in Apple from Australia. Here's how you might go about it:

Open a brokerage account: Choose a broker that offers international trading services and open an account.

Fund your account: Transfer funds from your Australian bank account to your brokerage account.

Research Apple: Look into Apple's financials, growth prospects, and dividend history to determine if it's a suitable investment for your portfolio.

Place your order: Use your brokerage platform to buy shares of Apple at your desired price.

Monitor your investment: Keep an eye on Apple's performance and make any necessary adjustments to your portfolio.

By following these steps, you can successfully buy US stocks from Australia and potentially benefit from the growth and stability of some of the world's leading companies.

us stock market today live cha