Arkema Stock Price: A Comprehensive Analysis

author:US stockS -Arkema(1)Comprehensi(5)Stock(238)Price(113)

In the ever-evolving world of financial markets, understanding the stock price of a company like Arkema is crucial for investors looking to capitalize on market trends. Arkema, a global chemical company, has seen its stock price fluctuate significantly over the years. This article delves into the factors influencing Arkema's stock price, providing a comprehensive analysis for investors and market enthusiasts.

Historical Performance

Arkema's stock price has experienced several ups and downs over the past decade. In the early 2010s, the company's stock price was relatively stable, hovering around

In the following years, the stock price fluctuated, reaching a peak of around

Factors Influencing Arkema's Stock Price

Several factors contribute to the fluctuation of Arkema's stock price. Here are some of the key factors to consider:

1. Economic Conditions

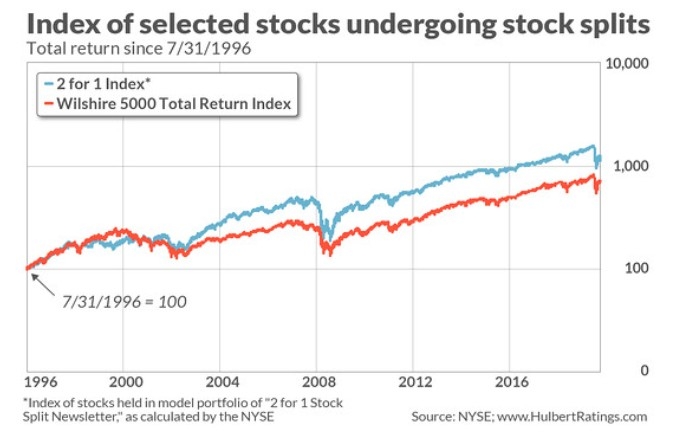

The global economic environment plays a significant role in influencing Arkema's stock price. Economic downturns, such as the 2008 financial crisis and the recent COVID-19 pandemic, have had a negative impact on the company's financial performance and, subsequently, its stock price.

2. Industry Trends

Arkema operates in the chemical industry, which is subject to various trends, including technological advancements, regulatory changes, and consumer demand. Positive industry trends, such as increased demand for sustainable chemicals, can drive the stock price higher.

3. Company Performance

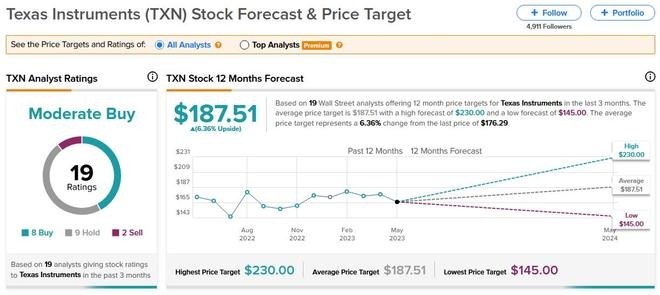

Arkema's financial performance, including revenue, earnings, and dividends, is a critical factor in determining its stock price. Strong financial results can lead to higher stock prices, while poor performance can result in a decline.

4. Market Sentiment

Market sentiment, or the overall perception of investors towards a particular stock or industry, can significantly impact Arkema's stock price. Positive news, such as successful product launches or strategic partnerships, can boost investor confidence and drive the stock price higher.

5. Dividends

Arkema has a history of paying dividends to its shareholders. The company's dividend yield, which is calculated by dividing the annual dividend per share by the stock price, is an essential factor for income-focused investors.

Case Study: Impact of the COVID-19 Pandemic

The COVID-19 pandemic had a profound impact on Arkema's stock price. In early 2020, as the pandemic began to spread, the stock price experienced a sharp decline, falling below $30 per share. However, as the company adapted to the new normal and continued to deliver strong financial results, the stock price gradually recovered, reaching pre-pandemic levels by the end of 2020.

This case study highlights the importance of adaptability and resilience in the face of unexpected challenges, which can significantly impact a company's stock price.

Conclusion

Understanding the factors influencing Arkema's stock price is essential for investors looking to make informed decisions. By analyzing historical performance, economic conditions, industry trends, and company performance, investors can gain valuable insights into the potential future movements of the stock price. As with any investment, it is crucial to conduct thorough research and consider the associated risks before making investment decisions.

us stock market today live cha