us stock market price

author:US stockS -Market(72)Stock(238)Price(113)Title(78)

Title: US Stock Market Price: Understanding the Dynamics and Influences

In today's fast-paced financial world, the US stock market price plays a crucial role in the investment decisions of individuals and institutions alike. This article aims to delve into the dynamics and various influences that shape the stock market price in the United States. By understanding these factors, investors can make more informed decisions and navigate the complexities of the stock market.

Understanding the US Stock Market Price

The US stock market price refers to the value of a stock, which is determined by the supply and demand for that particular stock. It represents the price at which investors are willing to buy and sell shares of a company. The stock market price fluctuates continuously, reflecting the market's perception of the company's performance, future prospects, and overall economic conditions.

Factors Influencing the US Stock Market Price

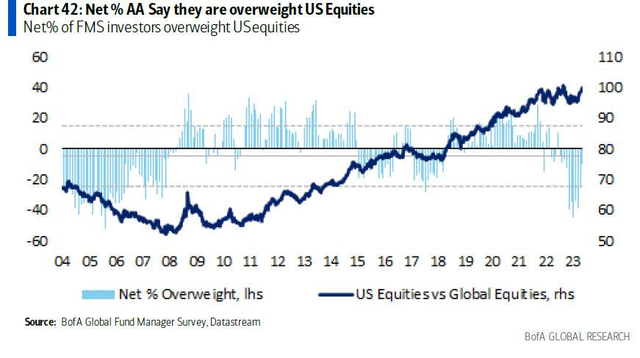

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation play a significant role in determining the stock market price. A strong economy with low unemployment and stable inflation tends to drive stock prices higher, while weak economic indicators can lead to a decline in stock prices.

Company Performance: The financial performance of a company, including its revenue, earnings, and profit margins, directly impacts its stock price. Companies that consistently deliver strong financial results are likely to see their stock prices rise, while those with poor performance may experience a decline.

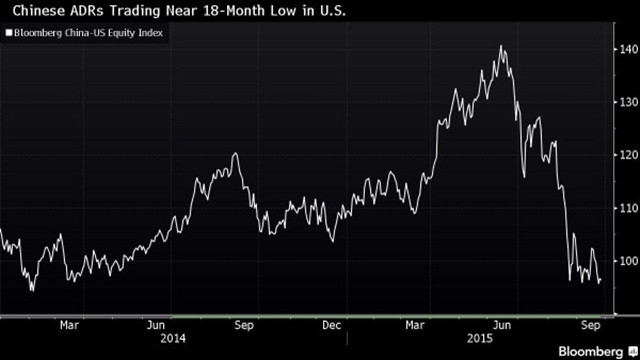

Market Sentiment: Market sentiment refers to the overall mood or outlook of investors towards the stock market. Factors such as political events, economic uncertainties, and geopolitical tensions can influence market sentiment, leading to volatility in stock prices.

Interest Rates: Interest rates set by the Federal Reserve (Fed) have a significant impact on the stock market. Higher interest rates can lead to increased borrowing costs for companies, which may negatively affect their profitability and stock prices. Conversely, lower interest rates can stimulate economic growth and boost stock prices.

Technological Advancements: Technological advancements can revolutionize industries and create new market opportunities. Companies at the forefront of technological innovation often see their stock prices surge, while those lagging behind may face a decline.

Case Studies

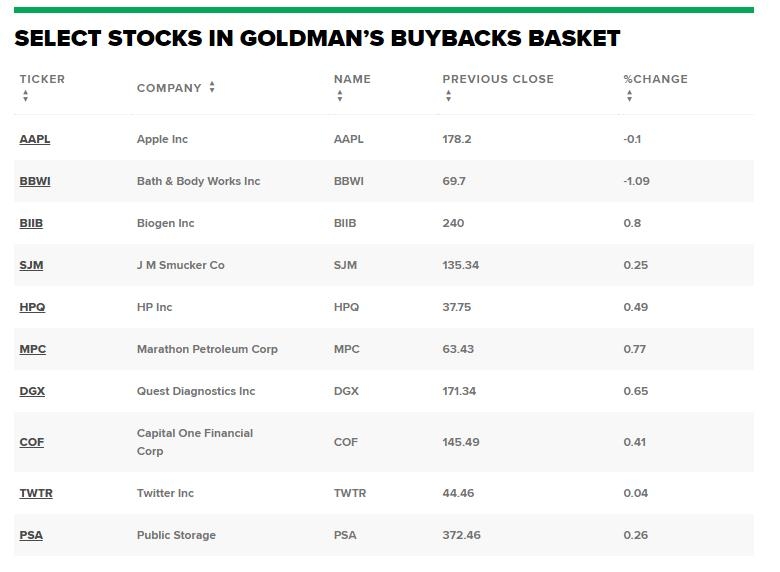

Apple Inc.: Over the past decade, Apple Inc. has consistently delivered strong financial results, driving its stock price higher. The company's innovative products, extensive ecosystem, and robust financial health have made it a favorite among investors.

Tesla Inc.: Tesla's stock price has experienced significant volatility due to its high growth potential and innovative approach to the electric vehicle industry. While the company has faced challenges, its long-term prospects have kept investors optimistic.

Conclusion

Understanding the dynamics and influences behind the US stock market price is essential for investors looking to navigate the complexities of the stock market. By considering factors such as economic indicators, company performance, market sentiment, interest rates, and technological advancements, investors can make more informed decisions and capitalize on market opportunities.

us stock market live