jd nasdaq share price

author:US stockS -Shar(3)share(59)nasdaq(250)Price(113)

JD NASDAQ Share Price: A Comprehensive Analysis

In the ever-evolving world of technology and e-commerce, the share price of JD.com, Inc. (NASDAQ: JD) on the NASDAQ Stock Market has been a topic of significant interest. This article aims to provide a comprehensive analysis of the factors influencing the JD NASDAQ share price, recent trends, and future prospects.

Understanding the JD NASDAQ Share Price

The JD NASDAQ share price refers to the current market value of JD.com, Inc. shares listed on the NASDAQ Stock Market. As one of the leading e-commerce platforms in China, JD's share price is a reflection of its financial performance, market sentiment, and industry trends.

Factors Influencing the JD NASDAQ Share Price

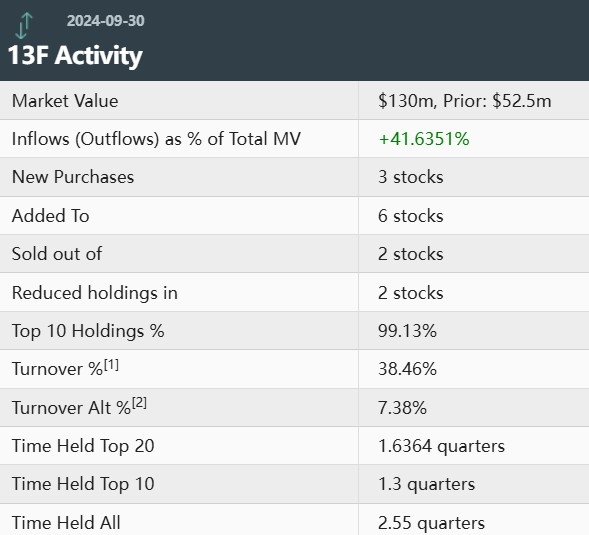

Financial Performance: The most crucial factor affecting the JD NASDAQ share price is the company's financial performance. This includes revenue growth, profit margins, and earnings per share (EPS). A strong financial performance tends to drive up the share price, while a weak performance can lead to a decline.

Market Sentiment: The overall market sentiment towards the e-commerce industry and JD.com specifically can significantly impact the share price. Factors such as economic conditions, consumer confidence, and regulatory changes can influence market sentiment.

Industry Trends: The e-commerce industry is highly dynamic, with constant innovation and technological advancements. Keeping up with these trends and adapting to changing consumer preferences is crucial for JD.com's success and, consequently, its share price.

Competition: The level of competition in the e-commerce industry, particularly from major players like Alibaba Group Holding Limited (NYSE: BABA) and Tencent Holdings Limited (HKEX: 0700), can impact JD's share price. Increased competition can lead to lower market share and profitability, negatively affecting the share price.

Recent Trends in the JD NASDAQ Share Price

Over the past few years, the JD NASDAQ share price has experienced significant volatility. Here are some key trends:

Initial Public Offering (IPO): In 2014, JD.com went public on the NASDAQ Stock Market, raising $1.5 billion. The IPO was a major milestone for the company and contributed to a surge in its share price.

COVID-19 Pandemic: The COVID-19 pandemic accelerated the shift towards online shopping, benefiting e-commerce companies like JD.com. However, the pandemic also brought challenges, such as supply chain disruptions and increased competition, which impacted the share price.

Regulatory Changes: The Chinese government's recent crackdown on tech giants, including e-commerce platforms, has raised concerns about potential regulatory risks for JD.com. These concerns have contributed to fluctuations in the share price.

Future Prospects for the JD NASDAQ Share Price

Looking ahead, the future of the JD NASDAQ share price depends on several factors:

Economic Recovery: As the global economy recovers from the COVID-19 pandemic, consumer spending is expected to increase, benefiting e-commerce companies like JD.com.

Innovation and Expansion: JD.com's ability to innovate and expand its product offerings, as well as its investment in technology and logistics, will play a crucial role in determining its future share price.

Regulatory Environment: The regulatory environment in China remains uncertain, and any significant changes could impact the company's operations and share price.

In conclusion, the JD NASDAQ share price is influenced by a variety of factors, including financial performance, market sentiment, industry trends, and competition. While the future remains uncertain, JD.com's commitment to innovation and expansion, along with its strong market position, make it a compelling investment opportunity.

us stock market live