Title: Can I Hold Us Stocks in My RRSP?

author:US stockS -

Introduction: Investing in stocks can be a wise decision for many investors, as it can potentially offer higher returns than traditional savings options. However, you may be wondering whether you can hold US stocks in your RRSP (Registered Retirement Savings Plan). In this article, we will explore the possibility of investing in US stocks within your RRSP and discuss the benefits and considerations involved.

Understanding RRSPs: An RRSP is a tax-deferred savings account designed to help individuals save for retirement. Contributions to an RRSP are tax-deductible, and taxes are only paid on the withdrawals made during retirement. This provides investors with a valuable opportunity to grow their savings tax-free.

Can You Hold US Stocks in Your RRSP? Yes, you can hold US stocks in your RRSP. However, there are certain requirements and limitations to consider.

Eligible Securities: To hold US stocks in your RRSP, the securities must be eligible. This means that they must be shares of a corporation or trusts that are publicly traded on a designated stock exchange. Examples of eligible securities include stocks listed on the New York Stock Exchange (NYSE) or the NASDAQ.

Reporting Requirements: When investing in US stocks within your RRSP, it is essential to report the details of the investment to your RRSP administrator. This ensures compliance with tax regulations and allows for accurate reporting of your RRSP contributions and withdrawals.

Benefits of Holding US Stocks in Your RRSP:

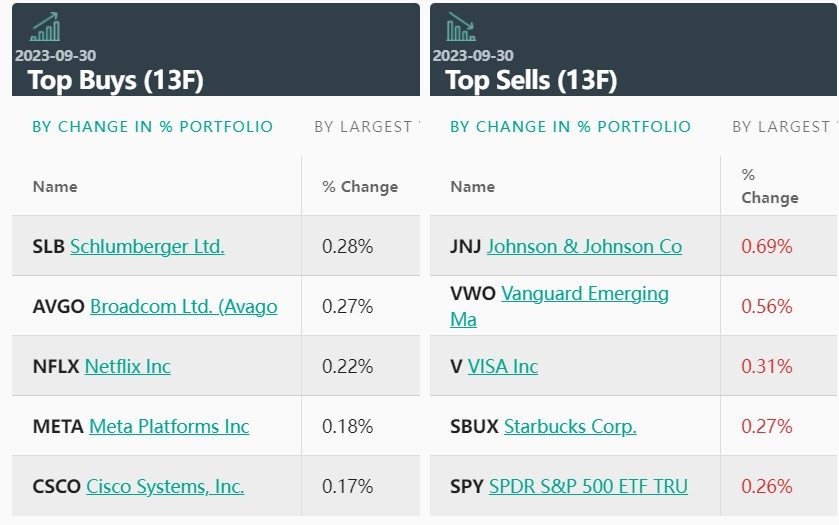

Potential for Higher Returns: Investing in US stocks can offer exposure to a diverse range of companies and industries, potentially leading to higher returns compared to investing in only Canadian stocks.

Diversification: Holding US stocks in your RRSP allows you to diversify your investment portfolio, reducing the risk of market fluctuations and volatility.

Currency Exposure: Investing in US stocks exposes you to the US dollar, which can provide a hedge against fluctuations in the Canadian dollar.

Considerations When Investing in US Stocks in Your RRSP:

Tax Implications: While US stocks held in your RRSP are tax-deferred, you may be subject to tax on dividends received from US companies. It is important to understand the tax implications and seek professional advice if needed.

Currency Fluctuations: Investing in US stocks exposes you to currency fluctuations, as the value of the US dollar can affect the returns on your investments.

Transaction Costs: Investing in US stocks may involve additional transaction costs, such as brokerage fees and currency conversion fees.

Conclusion: In conclusion, you can hold US stocks in your RRSP, providing you meet the eligibility criteria and reporting requirements. Investing in US stocks within your RRSP offers potential benefits such as higher returns, diversification, and exposure to a broader market. However, it is important to consider the tax implications, currency fluctuations, and transaction costs associated with investing in US stocks. As always, seeking professional advice is recommended to ensure you make informed investment decisions for your retirement savings.

us stock market live