Are U.S. Stocks Going to Crash? A Comprehensive Analysis

author:US stockS -

The stock market has always been a rollercoaster ride, and investors are always on the edge of their seats, questioning whether the market is due for a crash. The recent volatility has sparked discussions about the possibility of a U.S. stock market crash. This article delves into the factors that could lead to a crash and examines the likelihood of such an event.

Historical Perspective

To understand the current market conditions, it is crucial to look at historical data. The U.S. stock market has experienced several crashes throughout its history, such as the 1929 Great Depression, the 1987 Black Monday, and the 2008 financial crisis. Each of these crashes was triggered by different factors, but they all had one thing in common: a lack of investor confidence.

Current Market Conditions

Today, the U.S. stock market is facing several challenges. The COVID-19 pandemic has caused unprecedented disruptions to the global economy, leading to high unemployment rates and a decrease in consumer spending. Additionally, political tensions and trade disputes have added to the uncertainty.

Economic Factors

Several economic factors could potentially lead to a stock market crash. One of the primary concerns is inflation. The Federal Reserve has been implementing aggressive monetary policies to stimulate economic growth, but these policies have also led to increased inflation. If inflation continues to rise, it could erode the purchasing power of investors and lead to a sell-off in the stock market.

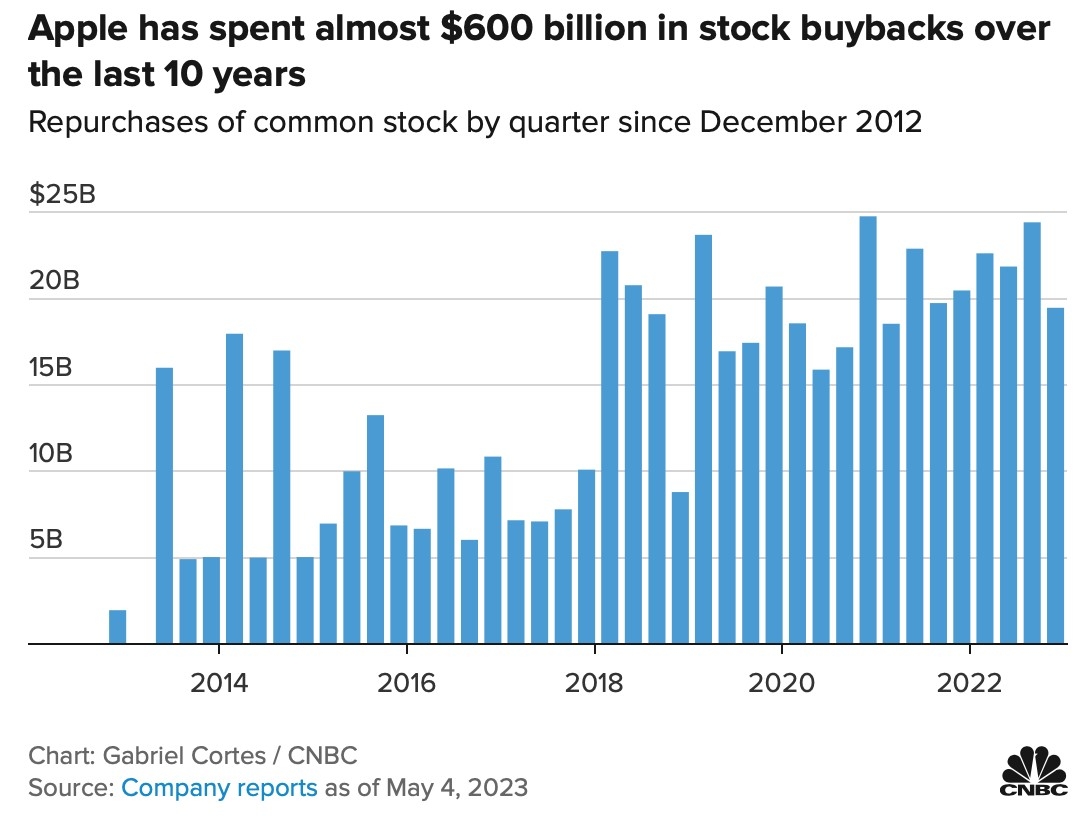

Another concern is the high levels of corporate debt. Many companies have taken on significant debt to finance their operations and expansion. If the economy takes a turn for the worse, these companies could face financial difficulties, leading to a decline in their stock prices.

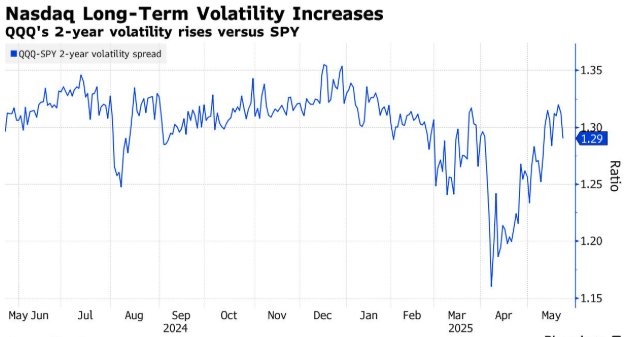

Technological Advances and Market Volatility

Technological advances have also played a role in the current market volatility. The rise of algorithmic trading has made the stock market more interconnected than ever before. This interconnectedness can lead to rapid and often unpredictable market movements. For example, the 2010 "Flash Crash" was caused by a computer algorithm executing a large sell-off in a matter of minutes.

Market Trends

Several market trends suggest that a U.S. stock market crash is unlikely in the near future. The U.S. economy has shown resilience, with GDP growth returning to pre-pandemic levels. Additionally, the Federal Reserve has signaled its commitment to maintaining low interest rates to support economic growth.

Case Studies

A notable case study is the 2008 financial crisis. The crisis was triggered by the collapse of the housing market, which led to a widespread credit crunch. The government responded by implementing various stimulus measures, including the TARP program, which provided financial assistance to troubled banks. These measures helped stabilize the market and prevent a complete collapse.

Conclusion

While the possibility of a U.S. stock market crash cannot be entirely ruled out, the current market conditions suggest that a crash is unlikely in the near future. Economic factors, market trends, and historical data all point to a more stable market. However, investors should remain vigilant and stay informed about the latest market developments.

new york stock exchange